Market News

ONGC share price tumbles 7% on sharp fall in oil prices; Oil India falls over 6.5%

.png)

2 min read | Updated on April 04, 2025, 10:53 IST

SUMMARY

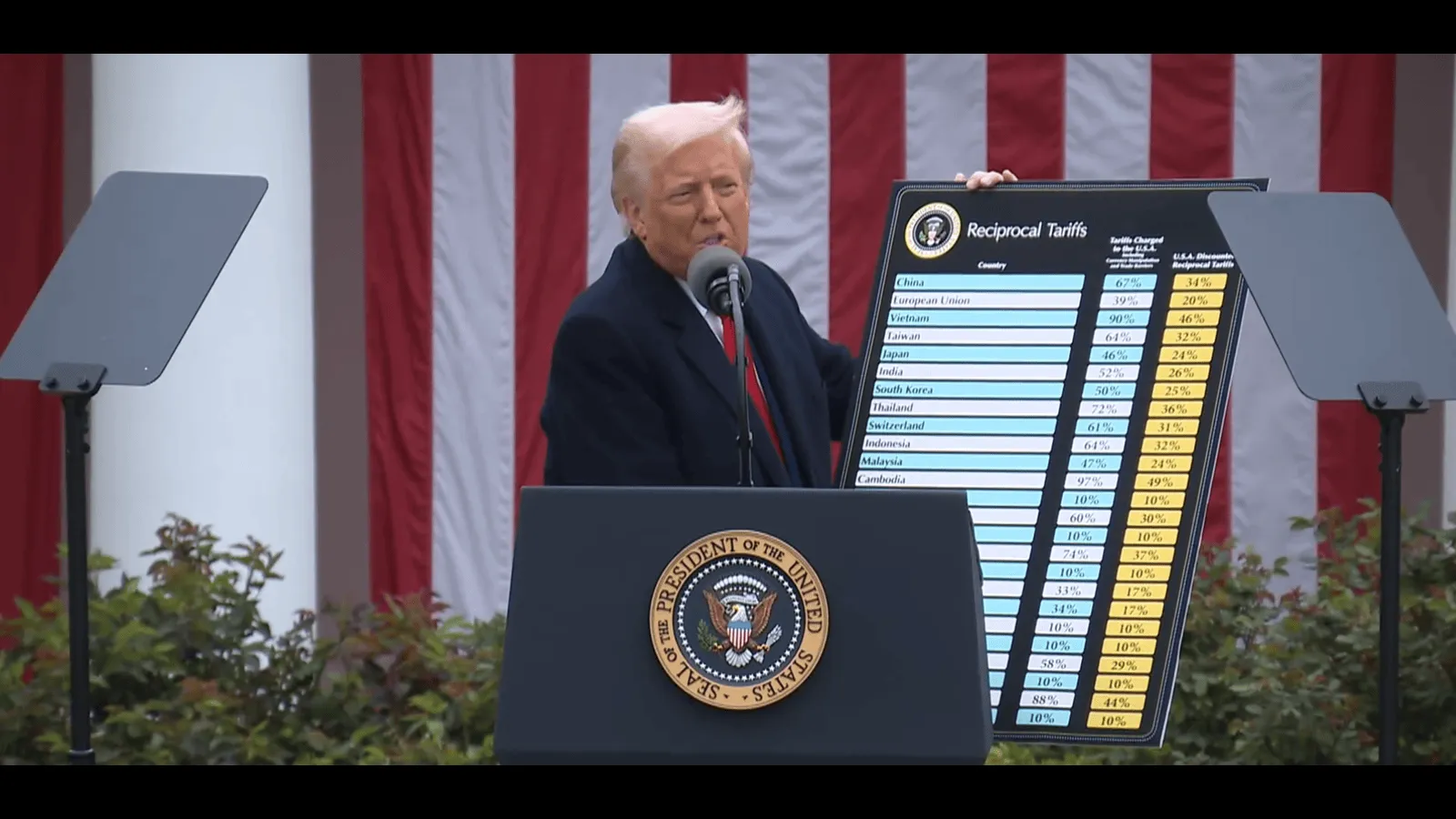

Oil prices fall: Oil prices tumbled on Thursday to settle with their steepest percentage loss since 2022 after OPEC+ agreed to a surprise increase in output the day after US President Donald Trump announced sweeping new import tariffs.

Both ONGC and Oil India Limited (OIL) are upstream oil companies, meaning they are involved in the exploration, development, and production of oil and gas resources. | Image: Shutterstock

Oil prices tumbled on Thursday to settle with their steepest percentage loss since 2022 after OPEC+ agreed to a surprise increase in output the day after US President Donald Trump announced sweeping new import tariffs.

Brent futures settled at $70.14 a barrel, down $4.81, or 6.42%. US West Texas Intermediate crude futures finished at $66.95 a barrel, down $4.76, or 6.64%, Reuters reported.

Eight OPEC+ countries unexpectedly agreed on Thursday to advance their plan to phase out oil output cuts by increasing output by 411,000 barrels per day in May, a decision that prompted oil prices to extend earlier sharp losses.

Both ONGC and Oil India Limited (OIL) are upstream oil companies, meaning they are involved in the exploration, development, and production of oil and gas resources.

Upstream companies are impacted negatively when oil prices fall since the price at which they sell oil is determined by the market, but their costs of production are largely fixed. If it costs more to produce a barrel of oil than it would fetch on the market, these companies will incur losses and eventually be affected in their overall business.

Hence, the shares of these companies came under heavy selling pressure today.

Last seen, ONGC was trading at ₹228.10 on the BSE, down 6.27%, while Oil India shares were down 5.84% at ₹363.4 apiece on the BSE.

Related News

About The Author

Next Story