Market News

Dixon Technologies plunges 15% in 1 month; here is what is ailing the EMS leader

3 min read | Updated on December 11, 2025, 13:16 IST

SUMMARY

Shares of Dixon Technologies are in focus after a sharp fall in the share price in one month. Profit booking at a higher levels, increased pressure from Chinese peers and revised guidance are few contributing factors to the fall. Additionally, the consistent decline in promoter holding also weighed on the risk sentiment for the stock.

Stock list

Shares oF Dixon Technologies are trading 28% down in 2025 on a YTD basis. |Image:Shutterstock.

Shares of Dixon Technologies are buzzing in trade amid broad broad-based correction in the midcap and smallcap stocks. The share price has fallen nearly 15% in December alone, and is trading over 33% lower than the record high levels. The company has delivered strong returns in the long run at a 46% CAGR over a 3-year time frame. The company is a leading EMS provider in India and a major beneficiary of PLI schemes announced by the government to support local manufacturing of electronic goods. After a robust growth in over three years, the stock price is now showing signs of exhaustion.

Profit booking at higher levels

Amid the broad-based correction in Indian markets and a lull performance in 2025, investors are now cashing out from the winners of the past. On a YTD basis, the shares have delivered -28% returns, a massive 2,889% rally in five years. Concerns over revamped guidance for its mobile services division could be one of the contributing factors for profit booking.

Consistent decline in promoter and FII holding

The promoter holding in Dixon Technologies has fallen from 34% in Q1FY24 to 28.9% in Q2FY26. The sharp decline in promoter holding despite robust earnings growth could probably unnerved investor confidence in the company. However, the management has clarified that promoter holding will remain stable from here on. Additionally, the FIIs have also pared their stake significantly in the past few quarters, adding to selling pressure on the stock. FIIs have reduced their stake in Dixon Technologies to 20.6% in Q2FY26 from 23.2% in Q3FY25. The trend highlights institutional and promoter shareholders preferring a lighter stake and cashing out on the liquidity at near record high valuations.

Competitive pressures from China

Contrary to the narrative of China+1 opportunity for India, the Chinese players are gaining ground in India’s EMS market as the relations between the two giants improve. According to media reports from the Economic Times, Chinese smartphone makers are diversifying their contract manufacturing away from Dixon Technologies. Instead of giving 100% volumes to Dixon Technologies, the smartphone manufacturers are adopting a more diverse strategy. Recent reports suggest, Motorola has diverted some manufacturing towards Karbonn away from Dixon. Additionally, Chinese-owned factories are also expanding their footprint in India as DBG Technologies and BYD ramp up their India operations to mitigate export risks.

Additionally, the management also gave conservative guidance of 40-41 million units, lower than approximately 50 million units previously guided, which aligns with the above trend.

Technical breakdown

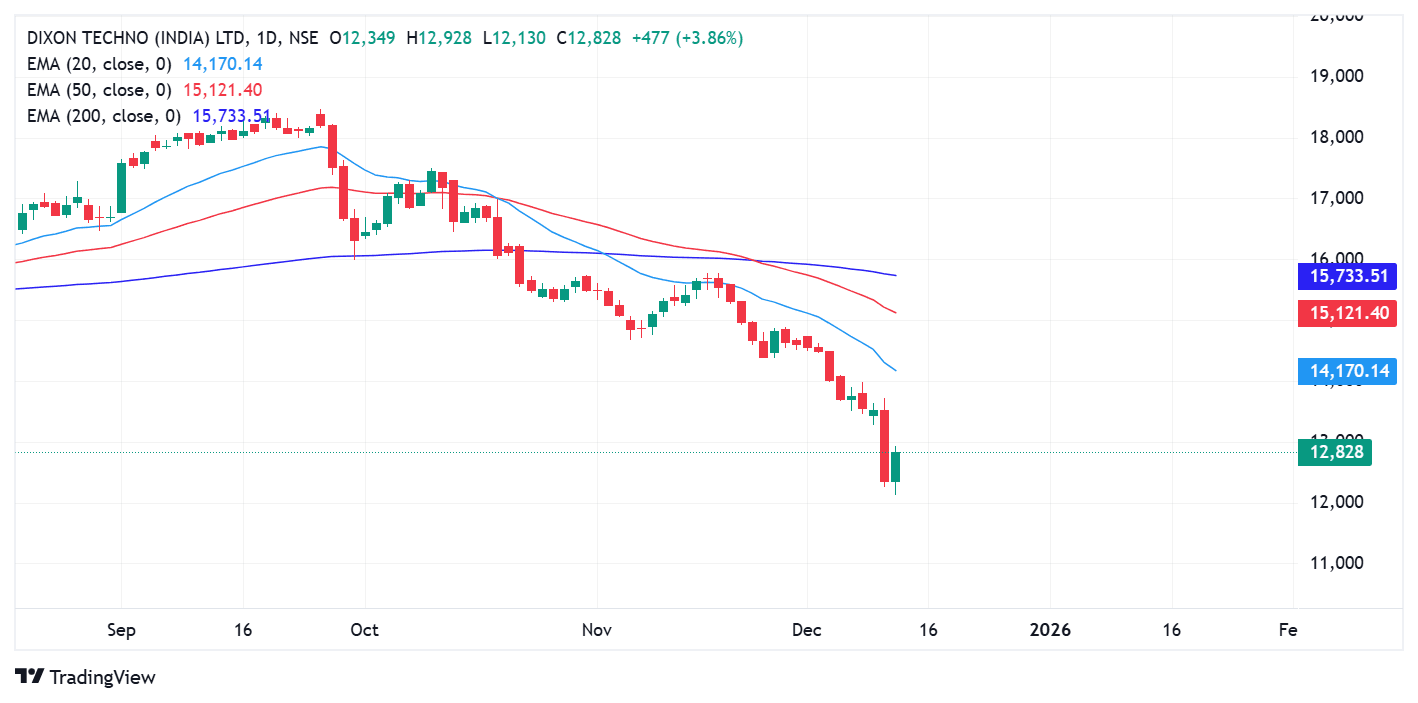

The technical charts indicate bearish sentiment gripping the stock price. The stock trades below the key long, medium and short-term moving averages of 20, 50, and 200 EMA on the daily charts.

On the weekly and monthly charts, the stock price has shown a double bottom formation at the level of ₹12,175, indicating some signs of stabilisation in the stock price after a sharp fall in a month. Experts believe, the stock price could consolidate further before deciding the next direction for the near term.

Apart from above triggers,slightly higher valuation than its peers and the industry average also concerned the long-term investos. However, company's dominant market share, robust financials and strong historical track record are key tailwinds which could spur the momentum back in the stock price.

About The Author

Next Story