Market News

RBI's Monetary Policy Committee keeps repo rate unchanged at 5.25%, expects growth momentum to sustain

.jpeg)

3 min read | Updated on February 06, 2026, 11:11 IST

SUMMARY

Governor Malhotra said that RBI expects growth momentum to sustain for long term as India reached free trade agreement with European Union and a bilateral traded agreement with the United States.

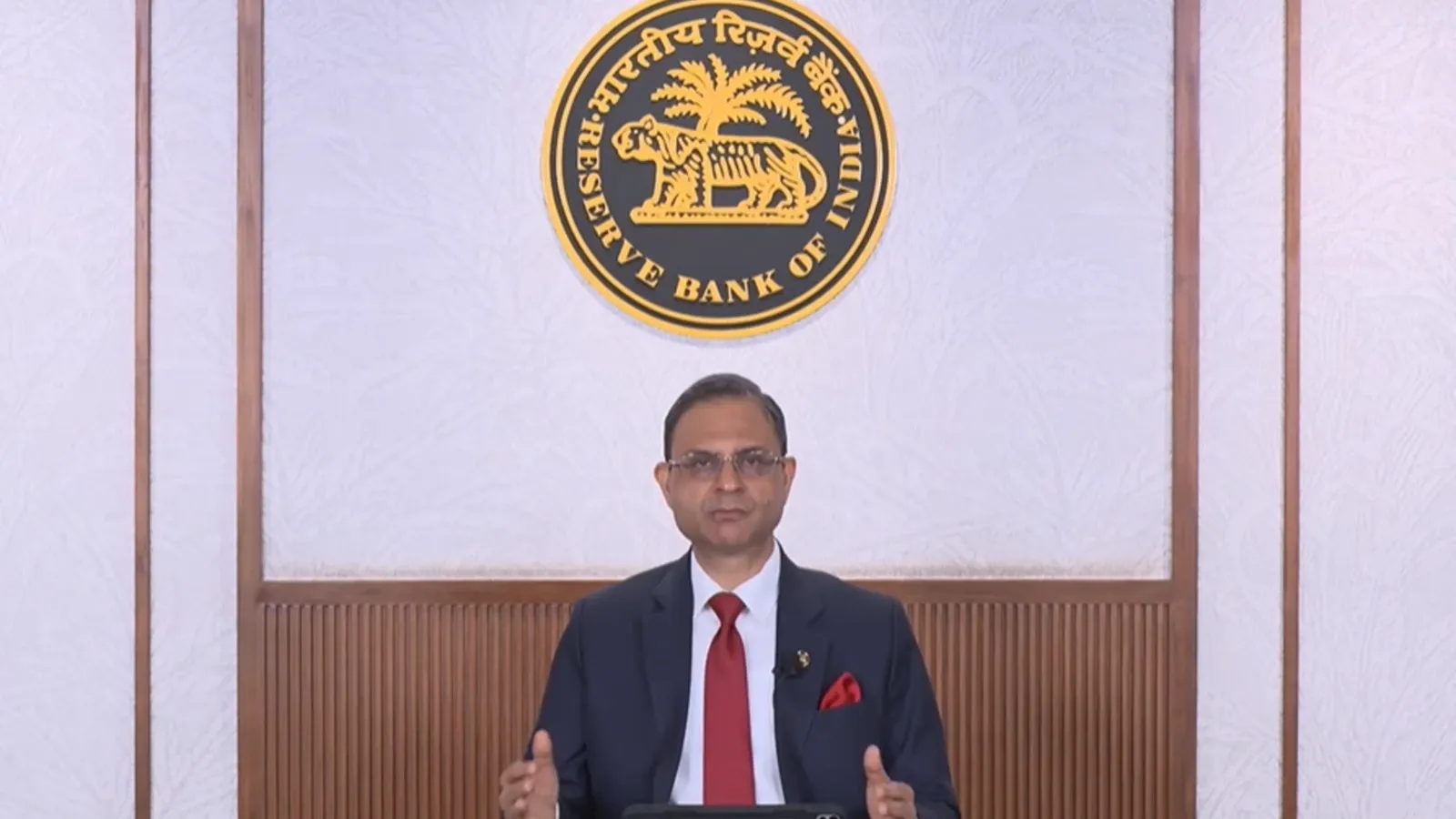

RBI Governor Sanjay Malhotra

The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) headed by Governor Sanjay Malhotra unanimously decided to keep repo rate unchanged at 5.25% and maintained its neutral policy stance at the conclusion of last monetary policy meeting of the current financial year.

In 2025, the RBI’s MPC had cut repo rate four times taking the total reduction to 125 basis points.

Governor Malhotra noted that global economy showed remarkable resilience in 2025, aided and supported by trade front-loading, a milder-than-anticipated impact of tariffs, broad fiscal stimulus and accommodative monetary policy.

RBI has pegged India’s gross domestic product (GDP) to grow at 7.4% in the current financial year and real GVA growth is projected to grow at 7.3% driven by buoyant services sector, resilient agricultural sector and revival in manufacturing activity.

Governor Malhotra said that RBI expects growth momentum to sustain for longer period as India reached a free trade agreement with European Union and a bilateral trade agreement with the United States was in sight.

"With the signing of a landmark trade deal with the European Union and the US trade agreement in sight, growth momentum is likely to be sustained for a longer period," Malhotra said.

"While services exports are expected to remain strong, merchandise exports will get a boost from the prospective trade deal with the US. The landmark comprehensive trade pact with the European Union coupled with trade deals with New Zealand and Oman should help diversify exports and strengthen the external sector," RBI's MPC said.

The RBI expects Indian economy to grow at 6.9% and 7% in the first and Q1 and Q2 of financial year 2026-27.

On the inflation front, RBI has pegged CPI inflation for 2025-26 at 2.1% with Q4 at 3.2%. For financial year 2026-27, CPI inflation for Q1 and Q2 is estimated at 4% and 4.2% respectively.

"Near-term outlook suggests that food supply prospects remain bright on the back of healthy kharif production, adequate buffer stocks of foodgrains and favourable rabi sowing. Core inflation, barring potential volatility induced by prices of precious metals, is expected to be range-bound. Geopolitical uncertainty coupled with volatility in energy prices and adverse weather events are other possible upside risks to inflation," MPC noted.

“Based on a comprehensive review of the domestic macroeconomic conditions and the outlook, the MPC is of the view that the current policy rate is appropriate. Accordingly, the MPC voted to continue with the existing policy rate. The MPC also agreed to retain the neutral stance. However, Prof. Ram Singh retained his view that the stance be changed from neutral to accommodative. Going forward, the MPC will be guided by the evolving macroeconomic conditions and the outlook based on data from the new series in charting the future course of monetary policy,” RBI’s MPC said.

Related News

About The Author

Next Story