Market News

Reliance Q4 results: Check earnings preview, dividend and key technical levels

.png)

4 min read | Updated on April 25, 2025, 09:21 IST

SUMMARY

Reliance Industries shares have surged over 11% in the last eleven trading sessions, indicating strong buying from the crucial support zone of ₹1,200. However, the broader structure of Reliance has been range-bound since November 2024 between ₹1,330 and ₹1,200. Unless the stock breaks this range on a closing basis, the trend may remain range-bound.

Stock list

Reliance Industries shares are broadly consolidating within the range of ₹1,330 and ₹1,200 for last six months.

Oil-to-telecom conglomerate Reliance Industries will announce its March quarter results on Friday, April 25. According to experts, Reliance is expected to report low single-digit growth in net profit and revenue.

As per experts, Reliance Industries’ consolidated Q4 revenue could see a marginal rise of 0.5-1% YoY to ₹2.34 to ₹2.38 lakh crore, while sequentially revenue could remain flat. The company reported revenue of ₹2.39 lakh crore in the previous quarter and ₹2.36 lakh crore in Q4FY24.

Net profit is expected to remain flat on a yearly basis to range between ₹18,750 to ₹18,860 crore. The company reported net profit at ₹18,540 crore in Q3FY25 and ₹18,951 crore in Q4FY24.

Overall, Reliance Industries earnings is expected to be a mixed bag as weakness in oil & gas business likely to balanced by higher revenue from telecom and retail segment.

Furthermore, Reliance Industries’ consolidated EBITDA could range between ₹42,970 to ₹43,580 crore, a rise of 2-4% aided by tariff hikes in the telecom business. The company increased its tariff for prepaid and postpaid plans in Q2FY25.

Investors will closely track Reliance Industries' Q4 results to gauge the performance of the retail, telecom and oil refining business. Management commentary on the overall business scenario will also be closely watched. Investors are also looking forward to any dividend announcement.

Ahead of the Q4 result announcement, Reliance Industries shares are trading 0.6% higher at ₹1,309 per share on Friday, April 25. So far this year, Reliance shares have delivered over 7% return to its investors.

Technical view

Reliance Industries shares are broadly consolidating within the range of ₹1,330 and ₹1,200 for the last six months. The stock is currently trading around its 200-day exponential moving average and has risen over 11% in the last eleven trading sessions.

Additionally, the stock has faced resistance around ₹1,330 zone and has failed to capture this zone on a closing basis. On the other hand, the immediate support is around ₹1,250 (50 EMA) and the crucial support is around ₹1,201. Within this range, the stock may remain range-bound and volatile.

Options outlook

Meanwhile, the open interest (OI) build-up of the 29 May expiry has the highest call base at 1,300 strike, indicating that the stock may face resistance around this level. On the other hand, the highest put OI was also seen at 1,300 strike. This indicates that the options market is expecting a range-bound movement around this strike.

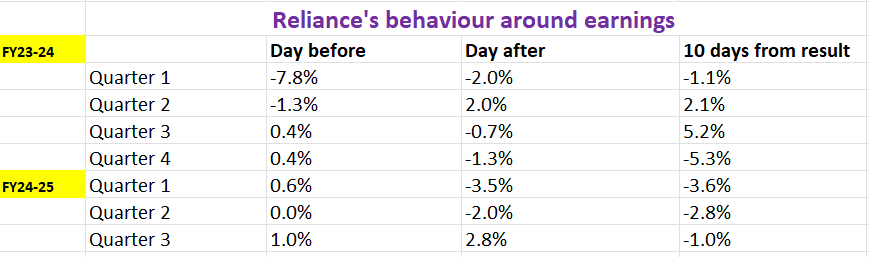

Before diving into strategies, let's review Reliance Industries’s share price movements arround its earnings announcements over the last seven quarters.

Options strategy for Reliance Industries

Based on options data suggesting a potential price movement of ±5.7%, traders have the opportunity to engage in either a long or short volatility strategy.

About The Author

Next Story