Market News

Maruti Suzuki Q4 results: Earnings preview, dividend, technical levels & more

.png)

3 min read | Updated on April 25, 2025, 09:22 IST

SUMMARY

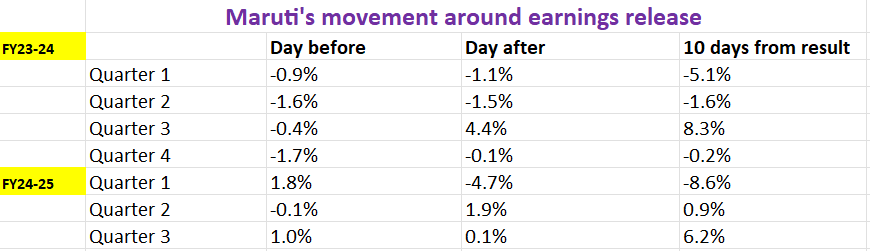

Ahead of its 29 May expiry, the options market is pricing in a ±6.6% move for Maruti Suzuki. On the technical front, the stock is trading within a falling wedge pattern. Last week, it formed a doji candlestick, suggesting that a breakout above or below the doji could offer clearer direction.

Stock list

Maruti Suzuki could report mixed Q4 results with revenue up 6-7% YoY to ₹40,670-₹40,930 crore

According to experts, Maruti Suzuki could report mixed Q4 results with revenue up 6-7% YoY to ₹40,670-₹40,930 crore, while net profit could decline 1-3% YoY to ₹3,760-₹3,880 crore. Rising average selling prices, volume growth and product mix are likely to benefit the company's quarterly earnings.

EBITDA margin for the March quarter is expected to contract by 40 to 60 basis points to 11.5–11.8% due to higher discounts and increased expenses.

Investors will closely monitor the company’s volume growth, inventory levels, and management’s commentary on demand outlook. They’ll also track updates on the launch and consumer response to Maruti Suzuki’s first electric vehicle, the e-Vitara.

Ahead of the Q4 result announcement, Maruti Suzuki shares are trading 0.4% higher at ₹11,946 per share on Friday, April 25. So far this year, Maruti Suzuki shares are trading 9.6% higher.

Technical view

The technical structure of the Maruti Suzuki as per the weekly chart remains at a critical juncture. The stock formed a doji candlestick pattern last week, which is a indecision pattern. It is currently trading above the high of the indecision pattern and its 21-week and 50-week exponential moving averages (EMAs). Additionally, the stock is trading with the falling wedge pattern.

For the upcoming sessions, traders can monitor the price action around the high and the low of the doji pattern. A close above the immediate resistance of ₹12,075 or below ₹11,525 can provide short-term directional clues.

Options outlook

Options strategy for Maruti Suzuki

Given the implied movement of ±6.6% from the options market ahead of the 29 May expiry, traders can consider using long and short Straddle strategies to capitalise on the anticipated volatility and potential price swings.

Related News

About The Author

Next Story