Market News

LTIMindtree Q4 Results: Net profit rises 4% QoQ to ₹1,128.5 crore; board recommends final dividend of ₹45/share

.png)

3 min read | Updated on April 23, 2025, 17:19 IST

SUMMARY

LTIMindtree Q4: The company had posted a profit of ₹1,085.4 crore in the December 2024 quarter. On a year-on-year (YoY) basis, profit grew by 2.6% against ₹1,099.9 crore logged in the year-ago period.

Stock list

The company also said that its board has recommended a final dividend of ₹45 per equity share. | Image: Shutterstock

The company had posted a profit of ₹1,085.4 crore in the December 2024 quarter.

On a year-on-year (YoY) basis, profit grew by 2.6% against ₹1,099.9 crore logged in the year-ago period.

In US dollar terms, net profit stood at $130.6 million, up 2% QoQ and down 1.4% YoY.

The company also said that its board has recommended a final dividend of ₹45 per equity share of ₹1 each for approval by members at the ensuing annual general meeting (AGM).

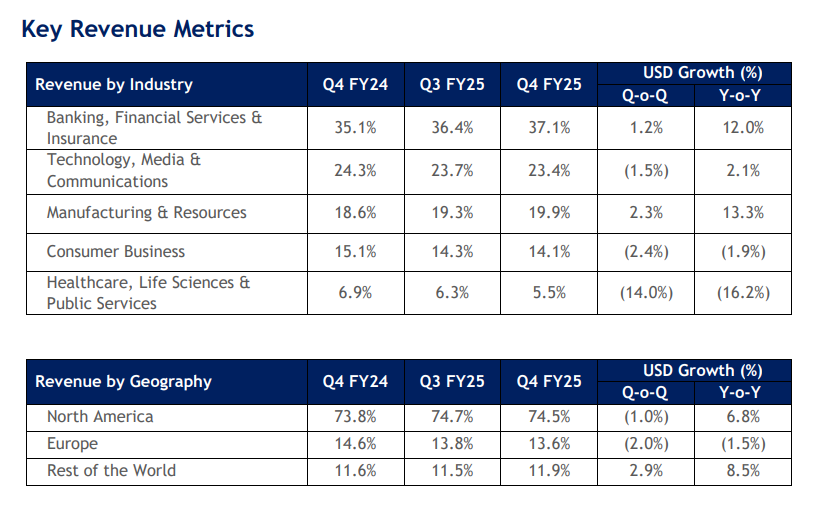

Revenue in US dollar terms came in at $1,131 million, up 5.8% YoY but down 0.7% QoQ. Revenue in rupee terms increased by 9.9% YoY to ₹9,771.7 crore against ₹8,892.9 crore logged in the corresponding quarter of the previous fiscal.

On a QoQ basis, revenue rose by 1.1% QoQ.

In constant currency (CC) terms, the company's revenue slipped 0.6% QoQ but increased 6.3% YoY.

Earnings before interest and taxes (EBIT) increased 2.8% YoY and 1.2% QoQ to ₹1,345.4 crore. EBIT Margin came in at 13.8% against 14.7% in the March FY24 quarter and 13.8% in the December quarter.

Basic earnings per share (EPS) stood at ₹37.2 in the March 2025 quarter against ₹38.1 in the year-ago period. In Q3 FY25, EPS was ₹36.7.

Commenting on the March quarter numbers, Debashis Chatterjee, Chief Executive Officer and Managing Director, said, “We concluded FY25 with a revenue growth of 5% in constant currency terms and an EBIT margin of 14.5%. Our key verticals and a major geography drove our yearly growth despite an ongoing challenging macro environment. The robust order inflow, driven by a significant array of AI-led deal wins, illustrates the pervasive integration of AI across our service offerings."

The CEO added, "Venu Lambu’s transition to LTIMindtree has been seamless and supports our strategic goals. His growing understanding of the organisation, combined with our ability to secure large deals, strong presence in tech-intensive sectors, and robust balance sheet, positions us well to leverage the opportunities ahead of us.”

FY25 Key Numbers

LTIMindtree said that its revenue in US dollar terms came in at $4,492.5 million, up 4.8% YoY, while operating margin (EBIT) was 14.5%.

Its net profit in US dollar terms stood at $543.9 million, down 1.7% YoY.

In rupee terms, the company's revenue for the fiscal year 2025 grew by 7% YoY to ₹38,008.1 crore, while net profit stood at ₹4,602 crore, up 0.4% YoY.

Order Inflow

LTIMindtree said its order inflow stood at $1.60 billion against $1.43 billion in Q4 F24 and ₹1.68 billion in Q3 FY25.

Key Employee Metrics

Total staff at the end of Q4 FY25 was 84,307 against 81,650 in the year-ago period.

TTM (trailing twelve months) attrition was unchanged YoY at 14.4%.

Appointment of Secretarial Auditor

LTIMindtree further said that the board of directors has approved and recommended for approval by members the appointment of M/s Alwyn Jay & Co., practising company secretaries, as secretarial auditors for a term of five consecutive years commencing from FY26 up to FY30.

The results were declared post-market hours. Shares of the company had settled at ₹4,538.50 apiece on the BSE, up 5.06%.

About The Author

Next Story