Market News

Kalyan Jewellers Q4 results: Check earnings preview, dividend and key technical levels

.png)

4 min read | Updated on May 08, 2025, 09:27 IST

SUMMARY

As per the options data of Kalyan Jewellers May expiry, the traders are expecting a ±11% move in either direction. Meanwhile, it is consolidating within the range of ₹594 and ₹420 since January and is forming a symmetrical triangle pattern on the daily and weekly chart.

Stock list

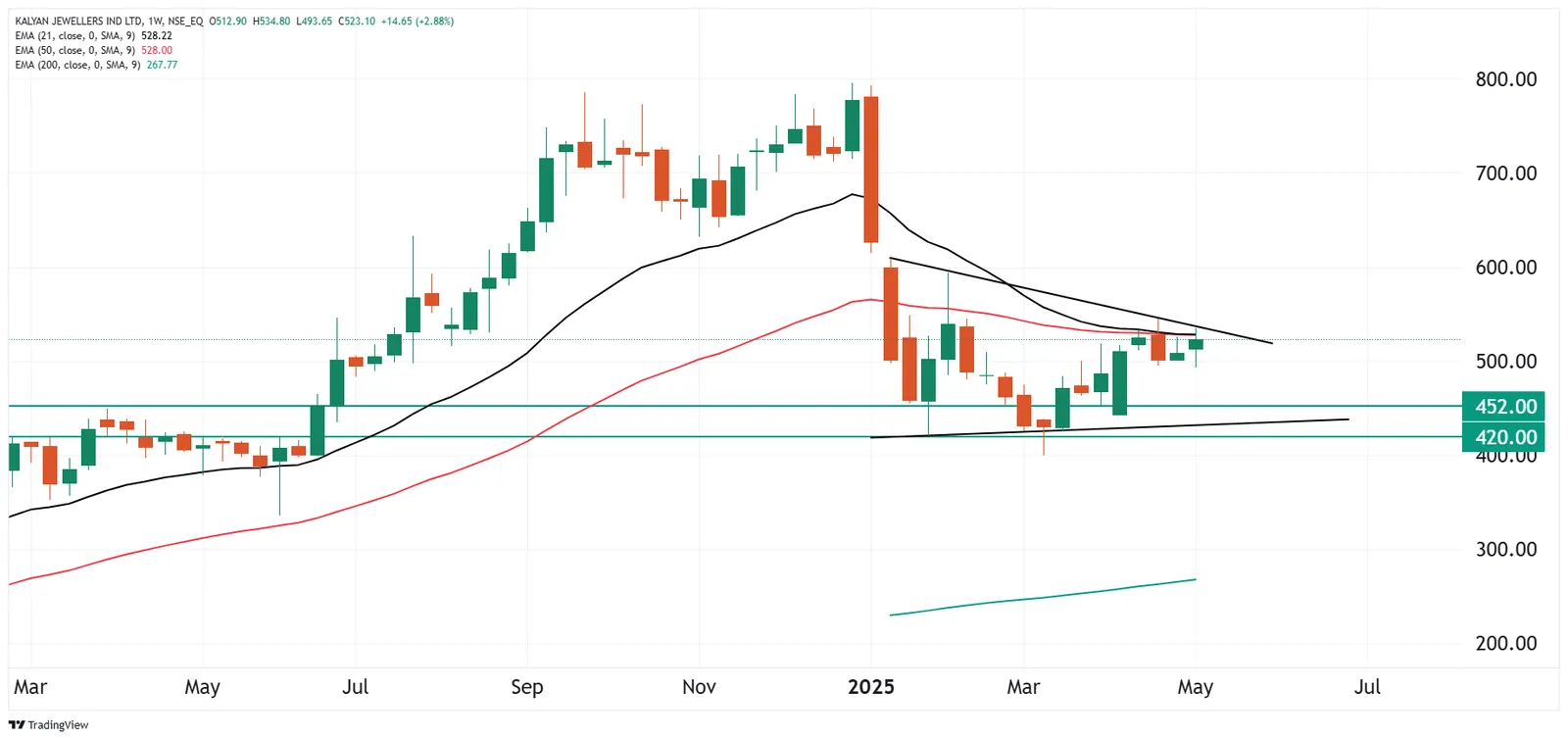

The technical structure of Kalyan Jewellers remains range-bound since January 2025 and is hovering between ₹594 and ₹420.

Jewellery retail chain Kalyan Jewellers will announce its March quarter results today. The company is expected to report double-digit revenue growth for the fourth quarter, according to its latest business updates.

Kalyan Jewellers reported a robust 37% year-on-year (YoY) increase in consolidated revenue for the fourth quarter of FY2025, despite significant volatility in gold prices. This growth was led by the company's India business, where sales grew by approximately 39% YoY, primarily driven by strong demand during the wedding season.

Meanwhile, same-store sales growth was approximately 21% during the quarter. The company expanded its retail footprint by opening 25 new showrooms in India during the fourth quarter, bringing the total number of stores to 388 as of 31 March 2025 ( India-278, Middle East-36, USA-1, Candere-73).

In the Middle East, Kalyan Jewellers recorded sales growth of approximately 24% YoY, with the region contributing approximately 12% to consolidated sales. Meanwhile, its digital-first jewellery platform, Candere, recorded a decline in revenue of approximately 22% over the same period.

Looking ahead, Kalyan Jewellers plans to open 170 new showrooms across its Kalyan and Candere formats in FY2026, including 90 Kalyan showrooms and 80 Candere showrooms in India.

In the December (Q3FY25) quarter, Kalyan Jewellers registered a consolidated net profit of ₹219 crore, up 21.2% YoY, while its revenue from operations stood at ₹7,287 crore, up 39.5% YoY during the same period.

Investors will closely watch management commentary on demand outlook, especially as gold prices remain near record highs. Key areas of focus will include same-store sales growth and any announcements regarding dividends.

Ahead of the Q4 results, Kalyan Jewellers shares trades flat at ₹522 on Thursday, 8 May. The company has delivered negative returns to investors in 2025, and is down more than 31% year-to-date.

Technical view

The technical structure of Kalyan Jewellers remains range-bound since January 2025 and is hovering between ₹594 and ₹420. It is currently forming a symmetrical triangle pattern on the weekly chart and is currently consolidating near the resistance zone of ₹546 and its 21-week and 50-week exponential moving averages.

For the upcoming sessions, traders can monitor the breakout or consolidation of Kalyan Jewellers within this symmetrical triangle pattern. A close above the immediate resistance of ₹546 with above average volume will signal strength. On the flip side, a rejection from this zone followed by a negative candlestick pattern will push the stock back into consolidation.

Options outlook

The open interest (OI) data for the 29 May expiry shows a significant concentration of call and put OI at the 520 strike. This indicates range-bound activity around this level.

Options strategy for Kalyan Jewellers

Given the implied move of ±11% from the options data, traders can initiate either a long or short volatility trade, taking into account the price movement. To trade based on volatility, a trader can take a Long or Short Straddle route.

About The Author

Next Story