Market News

Indian Hotels Q4 result: Net profit rises 25% to ₹522 crore, EBITDA jumps 30%; company announces dividend

.jpeg)

3 min read | Updated on May 05, 2025, 18:44 IST

SUMMARY

Indian Hotels' earnings before interest, taxes, depreciation, and amortisation (EBITDA) also known as operating profit rose 30% to ₹918.74 crore in March quarter from ₹706 crore in the same period last year.

Stock list

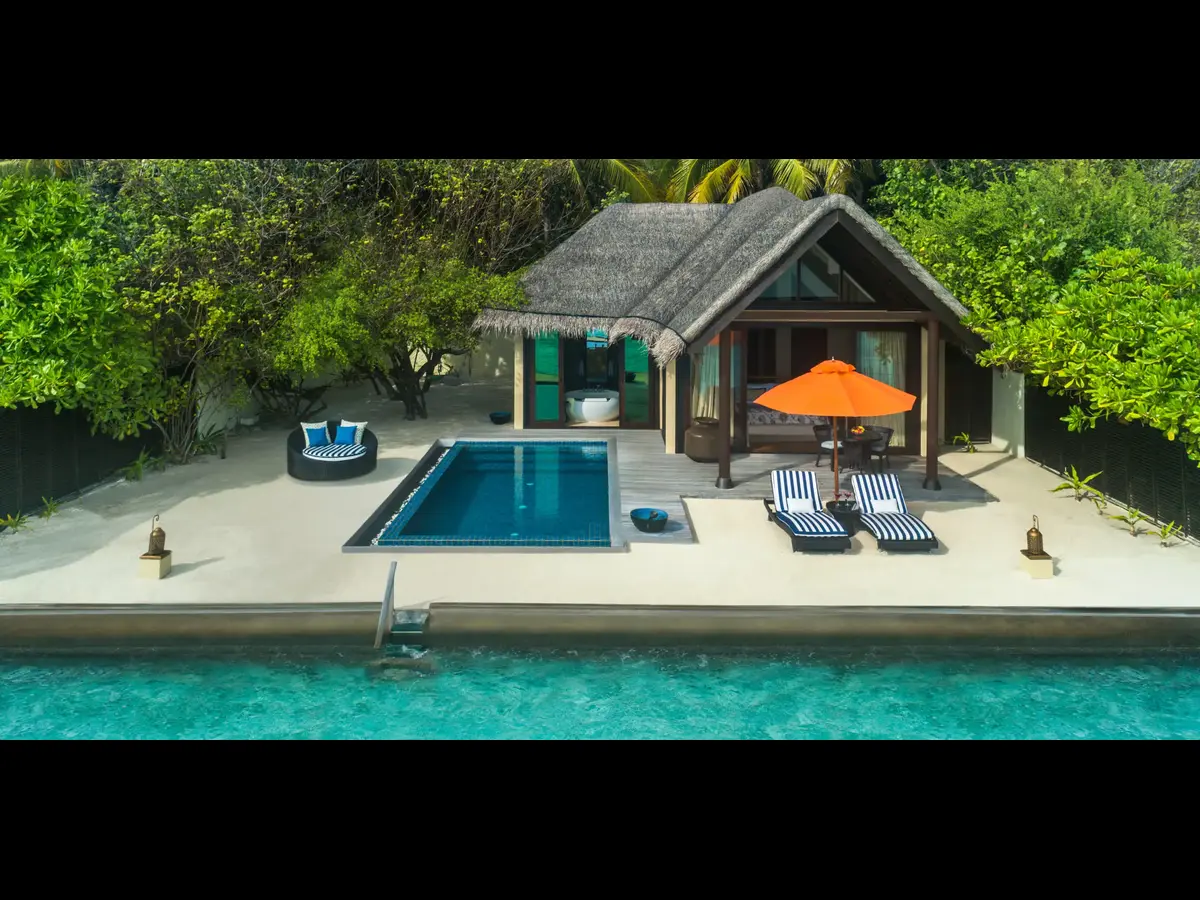

The Indian Hotels on Monday, May 5, reported a net profit of ₹522 crore in January-March quarter. | Image: Taj Hotels

The Indian Hotels, parent of five-star hotel chain operator Taj Hotels and Resorts, on Monday, May 5, reported a net profit of ₹522 crore in January-March quarter, marking an upside of 25% from ₹418 crore in the same period last year. Its revenue from operations rose 27% to ₹2,487 crore as against ₹1,951 crore in the year-ago period.

The company's earnings before interest, taxes, depreciation, and amortisation (EBITDA) also known as operating profit rose 30% to ₹918.74 crore in March quarter from ₹706 crore in the same period last year. For the quarter, operating profit margin (EBITDA margin) improved to 36.94% from 36.19%.

The company's board has recommended dividend of ₹2.25 per share for financial year 2024-25.

“Q4 marks twelve consecutive quarters of record performance with consolidated hotel segment revenue reporting a strong growth of 13% resulting in EBITDA margin of 38.5%. Enterprise revenue for the full year stood at ₹14,836 crore, 1.6x of consolidated revenue, in line with our strategy of a balanced capital light and capital heavy portfolio. The consolidated double -digit revenue growth for the year was driven by strong same store performance, 40% increase in New Businesses and not like for like growth. IHCL set a new benchmark with 74 signings and 26 openings this fiscal and over 95% of these signings were capital light,” said Puneet Chhatwal, Managing Director & CEO of Indian Hotels.

Indian Hotels domestic same store hotels delivered 12% consolidated revenue per available room (RevPAR) growth. Its international consolidated portfolio reported an occupancy of 73%, up 440 basis points, resulting in a RevPAR growth of 7%, the company said in a press release.

Management fee income grew by 20% to ₹562 crores on the back of not like for like growth, the company added.

The air and institutional catering business segment (TajSATS) clocked a revenue of ₹1,051 crore, 17% growth over the previous year and EBITDA margin at 25.2%. TajSATS has been consolidated during the second quarter, resulting in ₹724 crore revenue reported as a part of IHCL Consolidated revenue in FY25.

New Businesses vertical comprising of Ginger, Qmin, amã Stays & Trails and Tree of Life reported an enterprise revenue of ₹802 crore, a growth of 41% and consolidated revenue of ₹601 crore, a growth of 40%, the operator of Taj Hotels said.

Chhatwal added that the company will invest over ₹1,200 crore towards the continued comprehensive asset management & upgradation programme and greenfield projects with the focus on the iconic brand Taj and digital capabilities.

"Looking ahead at FY2026, IHCL is poised to continue double-digit revenue growth, driven by strong same-store performance, sustained momentum in New Businesses and 30 new hotel openings. The sector outlook remains strong, with demand outpacing supply, a recovery of foreign tourist arrivals and steady momentum across leisure, social and MICE segments," Chhatwal added.

Indian Hotels shares ended 0.19% higher at ₹801.80 ahead of its earnings announcement.

About The Author

Next Story