Market News

Bajaj Finance Q4 results: Check earnings preview, dividend and key technical levels

.png)

4 min read | Updated on April 29, 2025, 10:06 IST

SUMMARY

Bajaj Finance shares are trading within a range of ₹9,660- ₹8,990 within the rising channel. Traders can monitor this range, and a break of this range on a closing basis will provide further directional clues.

Stock list

On the daily chart, Bajaj Finance remains in an ascending channel, trading above its 21-day and 50-day exponential moving averages (EMAs)

Analysts expect the company to report strong growth in net interest income (NII) and net profit, driven by a healthy rise in its loan book and assets under management (AUM).

Bajaj Finance’s NII is projected to come in between ₹9,550 crore and ₹9,710 crore, reflecting a 19–21% year-on-year increase. Net profit is estimated to rise 11–16% year-on-year, landing between ₹4,270 crore and ₹4,450 crore.

In its recent business update, Bajaj Finance reported a 36% year-on-year jump in new loans booked, reaching 1.07 crore. AUM grew 26% year-on-year to ₹4.16 lakh crore, while the customer base expanded to 10.18 crore as of March 31, 2025.

During the Q4 earnings call, investors will closely watch management commentary on loan growth prospects, net interest margins, asset quality (gross and net NPAs), and any dividend announcement.

Ahead of the results, Bajaj Finance shares are trading 0.4% lower at ₹9,051 per share on Tuesday, April 29. Year-to-date, the stock has delivered over 32% returns to investors.

Technical View

On the daily chart, Bajaj Finance remains in an ascending channel, trading above its 21-day and 50-day exponential moving averages (EMAs).

However, the stock has encountered resistance near the ₹9,660 level, forming a bearish candlestick pattern. Immediate support is seen at ₹8,990. For the short-term direction, traders should watch the ₹8,990-₹9,660 range. A decisive close above or below this band could signal the next move.

Options outlook

Options strategy for Bajaj Finance

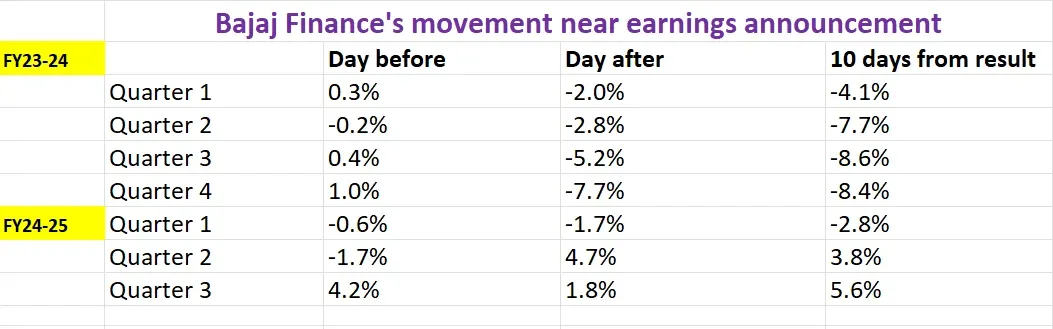

Given the implied movement of ±7.4% from the options market ahead of the May 29 expiry, traders can take a look at the Long and Short Straddle strategies to take advantage of the anticipated volatility and price swings.

About The Author

Next Story