Market recap (as of 5:30 pm)

- Gold 5 June Futures: ₹93,869 (▼ 1.8%)

- Silver 5 May Futures: ₹93,500 (▼ 3.4%)

- Crude Oil 19 May Futures: ₹5,093 (▼ 1.4%)

Gold: The yellow metal fell on Wednesday, with June futures dropping 1.2% to $3,292 per ounce. The decline was driven by a stronger U.S. dollar and easing U.S.-China trade tensions, including President Trump's agreement to lift some auto import tariffs. Investors are also cautious ahead of key U.S. economic data this week, such as the ADP non-farm employment report and Q1 GDP figures. Silver followed suit, falling over 3% in futures trading to $32.20 per troy ounce.

Crude Oil: International crude oil futures slipped on Wednesday, with Brent trading around $62.56 per barrel, down 1.1%, and WTI down 1.2% at $59.70. Prices continued to decline, putting oil on track for its steepest monthly drop since 2021. The sell-off followed weak April manufacturing data from China, stoking demand concerns. Additionally, easing tensions between Russia and Ukraine, along with speculation about a potential OPEC+ production hike, added pressure by raising the prospect of increased supply.

Technical structure

Gold: The technical structure of the MCX gold remains weak and is currently trading below the crucial support zone of ₹93,900. A close below this level and the 21-day exponential moving average will indicate further weakness. Meanwhile, the immediate resistance remains around ₹99,400.

Silver: After a weak start, the silver prices of MCX’s May futures contract slumped over 3% and is currently trading below the low of previous seven sessions. It is forming a bearish candlestick pattern on the daily chart and is trading below all the three daily exponential moving averages like 21,50 and 200. Meanwhile, a close below the immediate support zone of ₹94,148 will further weaken the sentiment. The resistance remains around the high of the previous doji candlestick pattern.

Crude oil: Oil prices slipped over 6% in last three trading sessions and slipped towards the immediate support of ₹5,000. The broader structure of the crude remains weak within the range of ₹5,700 and ₹5,000 since last three weeks after the breakdown of falling wedge pattern. For the upcoming sessions, traders can monitor the price action around ₹5,000. A close below this level will further weaken the sentiment. Conversely, the resistance for the crude around ₹5,700 and 5,400.

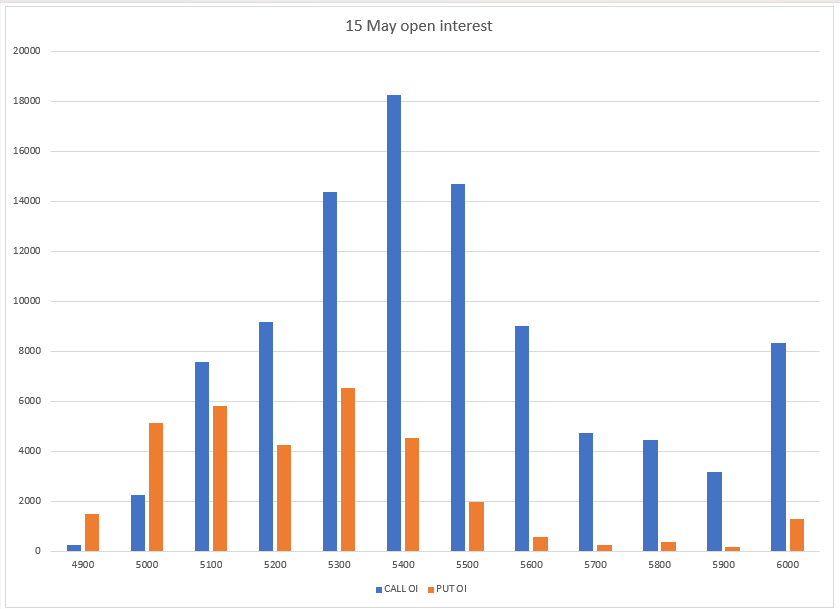

The open interest data for the 15 May expiry saw significant call options build-up at 5,400 and 5,500 strikes, indicating resistance for the crude around these levels for the 15 May expiry.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

.png)