Market recap (as of 06:15 pm)

- Gold 5 June Futures: ₹95543 (▼ 1.8%)

- Silver 5 May Futures: ₹96,138 (▲ 0.2%)

- Crude Oil 19 May Futures: ₹5417 (▼ 0.6%)

Gold: The yellow metal traded lower on Wednesday, with gold June Futures trading at $3,336 per ounce, down 2.4%. Gold prices are lower today amid potential de-escalation in the US-China trade war after US President Donald Trump statement. Firm US dollar index also weighed on gold prices. Meanwhile, silver prices also traded lower, down 0.14% at $32.8 per troy ounce in the futures market.

Crude Oil: International crude oil futures traded lower today, with Brent Futures trading around $66.81, down 0.9%, while WTI Crude traded 0.9% lower, around $63. Oil prices rose after Kazakhstan’s new Energy Minister said the country will prioritise national interests over those of the OPEC+ producer group when deciding its oil output levels. Higher oil supply with stable demand outlook to lead to fall in the oil prices.

Technical structure

Gold: The price of yellow metal extended profit-booking for the second day in a row and slipped over 4% from the high of 22 April. It formed a doji candlestick pattern on the daily chart in the previous session and is currently trading below the previous session’s low. However, the crucial support zone of gold remains around ₹93,940. Unless the gold slips below this zone, the broader trend may remain sideways to bullish.

Silver: The price of precious metal extended the consolidation for the fourth session in a row and is currently trading above 21, 50 and 200-day exponential moving averages (EMA). For short-term directional clues, traders can monitor the crucial resistance zone of ₹97,147 and immediate support of ₹94,148. A breakout from this range with a strong candle and on a closing basis, it may provide directional insights.

Crude oil: Oil prices rebounded towards its 21-day EMA and is currently facing resistance around this zone. However, the broader trend of the crude remains sideways to bearish with resistance around ₹5,675. Unless crude prices reclaims this crucial resistance zone on a closing basis, the trend may remain sideways to bearish. Meanwhile, the immediate support remains around ₹5,082.

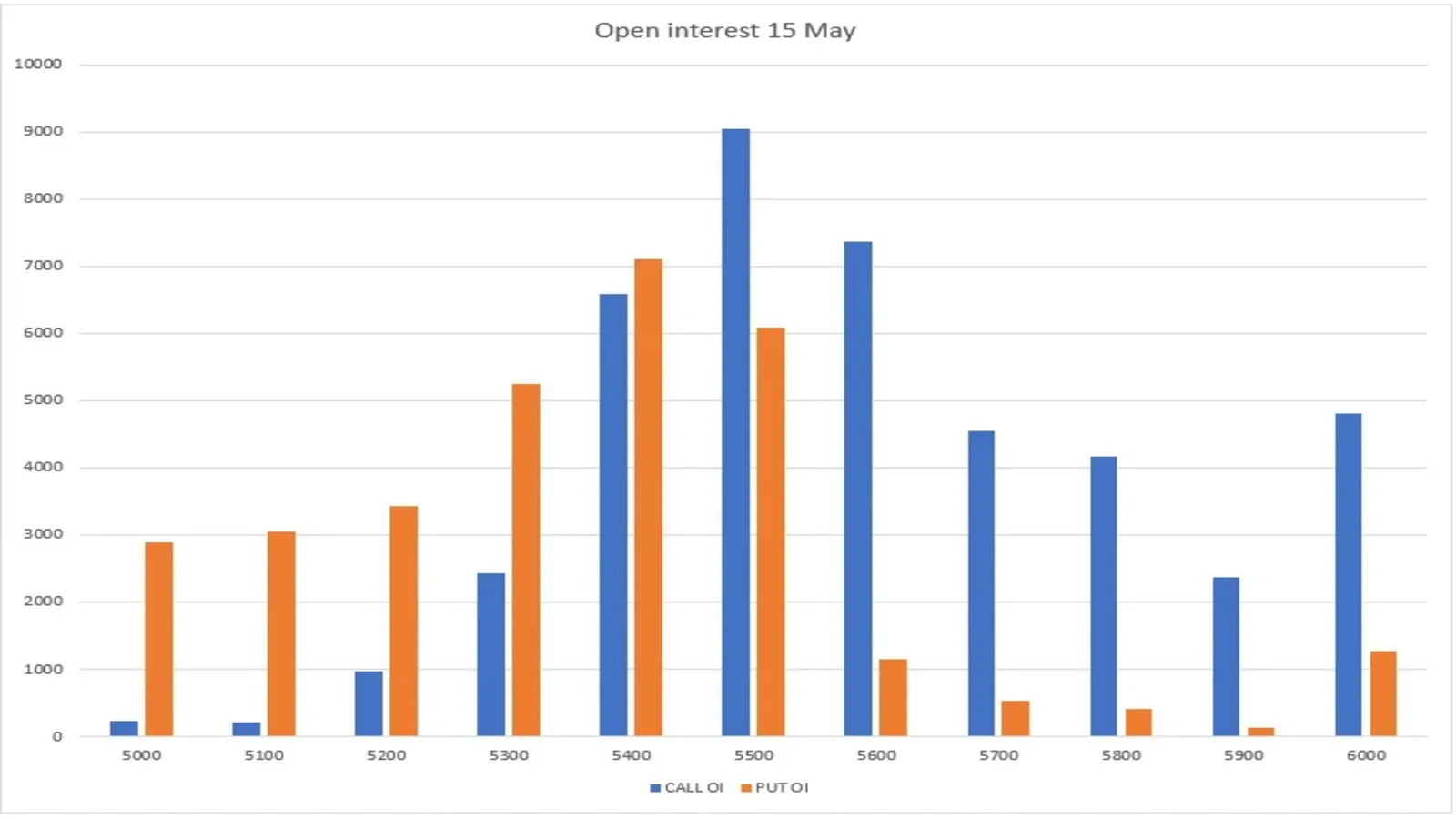

The open interest data for the 15 May expiry saw significant call base at 5,500 and 5,600 strikes, indicating resistance for the crude oil around this zone. On the flip side, significant call and put base was observed at 5,400 strike, suggesting range-bound movement around this strike.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

.png)