Market News

MCX Crude oil hits four-year low, Gold and silver rebound ahead of US Fed meet; check today’s trade setup

.png)

3 min read | Updated on May 05, 2025, 15:17 IST

SUMMARY

MCX Crude prices fell below the key ₹5,000 support level, dropping over 4%. While crude is still holding above immediate support, a close below this level could further weaken market sentiment.

Stock list

GOLD

--

MCX Gold stays under ₹95,000 as trade tensions cool, Oil stays under 21 EMA

Market recap (as of 3:00 pm)

- Gold 5 June Futures: ₹94,272/ 10 gram (▲ 1.7%)

- Silver 5 May Futures: ₹94,728/ 1 kg (▲ 0.7%)

- Crude Oil 19 May Futures: ₹4,838/ 100 BBL (▼ 2.0%)

Gold: The yellow metal traded higher on Monday, with gold June Futures trading at $3,271 per ounce, up 0.8%. Gold prices are trading higher, supported by a weaker US dollar index as traders await more information on US-China trade talks. Additionally, investors are focusing on the upcoming U.S. Federal Reserve policy meeting scheduled later this week. As per experts, the central bank is expected to maintain current interest rates despite Donald Trump's calls for a rate cut. Meanwhile, silver prices also traded higher, up 0.9% at $32.5 per troy ounce in the futures market.

Crude Oil: International crude oil futures traded lower today, with Brent Futures trading around $59.9, down 2.2%, while WTI Crude traded 2.4% lower, around $56.8. Oil prices are down after OPEC+ decided to increase production output, signalling surplus supplies in the coming months.

Technical outlook

Gold: The yellow metal started the Monday’s session on a positive note and attempting to reclaim its 21-day exponential moving average (EMA). However, the short-term structure of the gold remains range-bound with immediate reistance around ₹94,300 zone. Unless gold reclaims this resistance zone on a closing basis, it may consolidate between ₹94,300 and ₹90,800.

Silver: Silver prices rebound over and is currently forming second inside candlestick pattern on the daily chart. However, the broader trend of the silver remains weak as it slipped below the key EMAs like 21, 50 and 200 on 30 April. The immediate resistance for the silver on MCX remains at 94,100. Unless silver reclaims the immediate resistance, the trend may remain weak.

Crude oil: Oil prices dropped over 4% and slipped below the crucial support zone of ₹5,000. However, it made a swift recovery of over 2% from the day’s low and is currently protecting the ₹5,000 zone on a closing basis. In the near-term, the technical structure of the crude remains weak with immediate support around ₹5,000, while the resistance remains at ₹5,100.

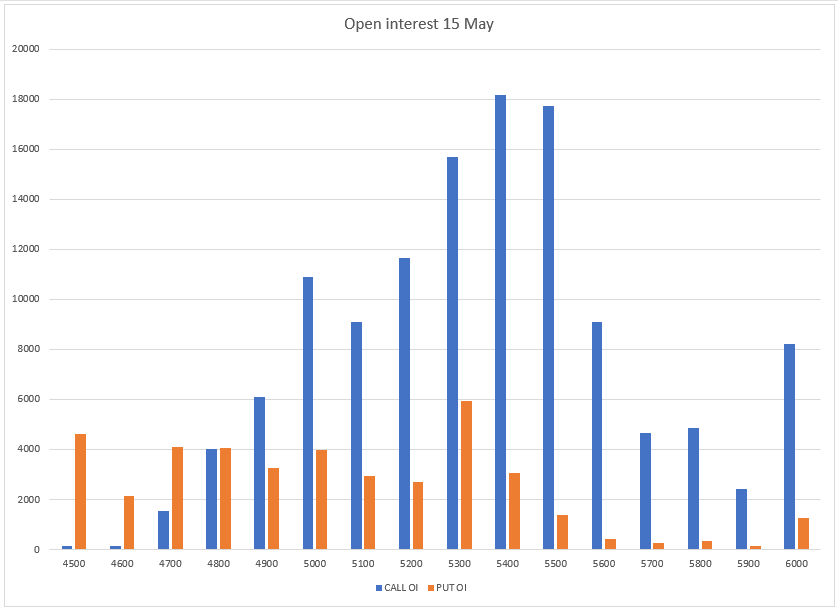

Open interest data for the 15 May expiry shows a significant call build-up at the 5,400 and 5,500 strikes, suggesting resistance for crude around this zone. In contrast, put option interest remains minimal, with low volumes.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for the client's consumption, and such material should not be redistributed. We do not recommend any particular stock, securities, or strategies for trading. The securities quoted are exemplary and are not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Take your own decision before investing.

About The Author

Next Story