Business News

US tariffs to hit growth harder than inflation, warns RBI Governor Malhotra

.png)

2 min read | Updated on April 09, 2025, 13:19 IST

SUMMARY

The Reserve Bank of India (RBI) cut its key interest rate for the second time in a row, lowering the repo rate to 6% and shifting its policy stance to "accommodative" to support a slowing economy.

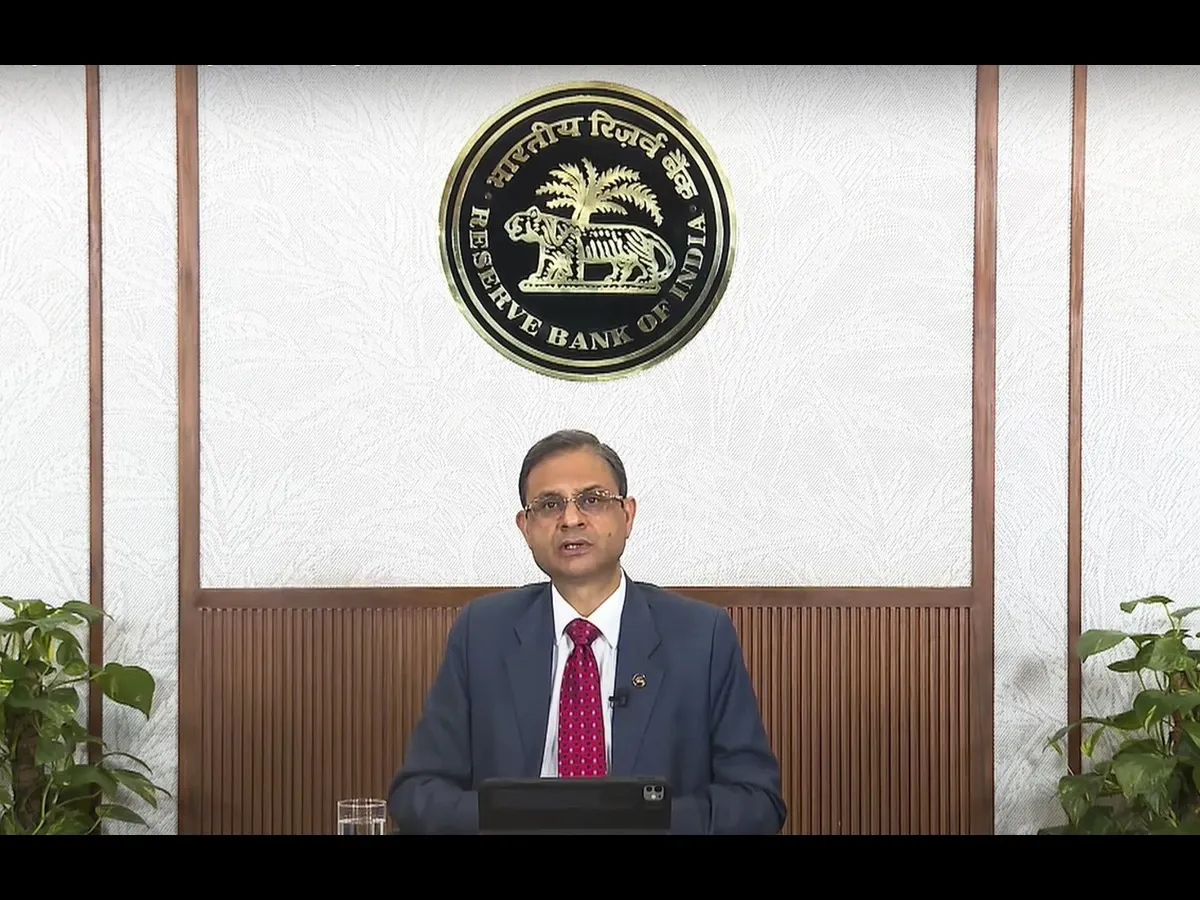

RBI Governor Sanjay Malhotra announces the first bi-monthly monetary policy, in Mumbai, Wednesday, April 9, 2025

The US tariffs are expected to weigh more heavily on economic growth than on inflation, Reserve Bank of India Governor Sanjay Malhotra said on Wednesday, as the central bank cut interest rates for a second consecutive time to support the slowing economy.

Malhotra highlighted that most of the forecasts for the global growth rate have come down by at least 20-30 basis points for the current as well as next fiscal.

“There is mixed response globally for inflation, especially for the US, it is projected to go up because of the tariffs that they will be imposing. For other countries, the impact would be different depending on the situation that they are in,” Malhotra said at the post-Monetary Policy press conference.

“For India, we have given our assessment. Growth rate has been reduced by 20 basis points this year. On the inflation front, we have said it can move both ways… but all in all, more than inflation, we are concerned about its impact on growth,” he said, pointing to a potential demand slowdown from the trade tariff frictions.

The RBI governor’s remarks came on a day when the full 26% additional tariffs on Indian goods exported to the US came into effect. The tariff hike adds to global headwinds, with some economists estimating a 20-40 basis point drag on India’s GDP growth in the current fiscal.

The RBI’s Monetary Policy Committee (MPC) unanimously voted to reduce the key repo rate by 25 basis points to 6%, the lowest since November 2022. This follows an identical rate cut in February, the first since May 2020. The committee also shifted its policy stance from “neutral” to “accommodative,” signalling further rate cuts ahead.

Malhotra said crude oil prices had declined and could ease some inflationary concerns, but reiterated the central bank’s focus on sustaining growth amid a challenging global environment.

The RBI retained its inflation projections but lowered its GDP growth forecast for the current fiscal by 20 basis points, citing global uncertainties and trade-related risks.

About The Author

Next Story