Recently Listed SME IPOs 2026

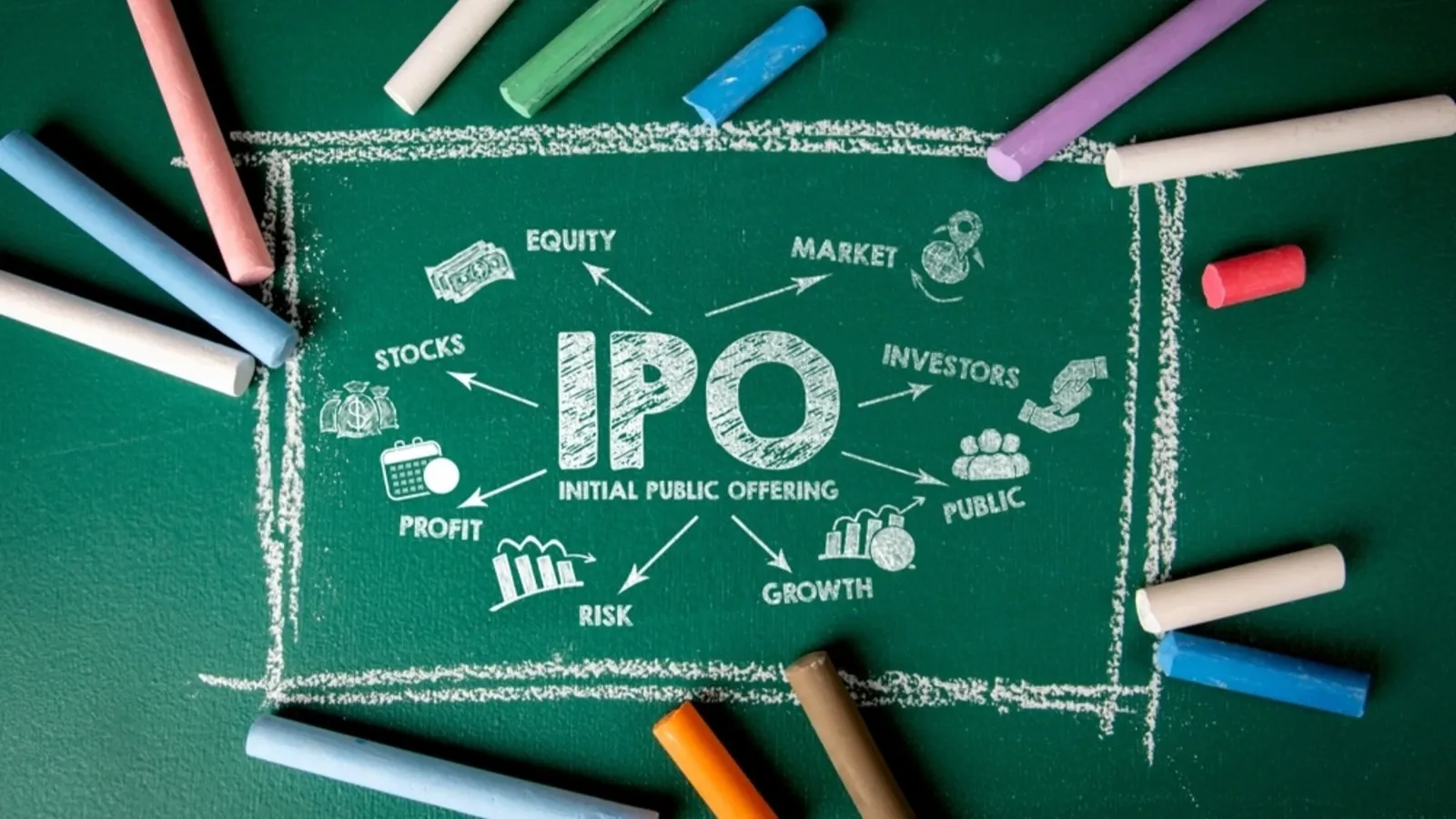

How to apply for IPOs on Upstox

Step 1

Go to www.upstox.com/ipo or open the Upstox mobile app and select the IPO you wish to apply for from the 'Open IPO' section

Step 2

Click on apply, enter the lot size, price and provide your UPI mandate.

Step 3

Approve the UPI mandate on your UPI app and you are all set!

Latest News on

What does it mean for an SME IPO to be listed?

When an SME IPO is listed, it means the company’s shares are now publicly available for trading on the stock exchanges, like the BSE SME and NSE Emerge platforms. The SME IPO performance can be tracked after the listing of the stocks following a successful IPO subscription. Once listed, the company’s stock is open for buying and selling, allowing investors to trade their holdings. Recently listed SME IPOs undergo significant scrutiny during the listing process. The listing also brings visibility and credibility to the company. It also means that the company is now subject to regulations of the stock exchanges, and market regulator the Securities and Exchange Board of India (SEBI).

What are the potential advantages and risks of investing in listed SME IPOs?

Investing in recently listed SME IPOs offers various advantages, such as the opportunity to invest in small-cap stocks that may have significant growth potential. SME IPO performance can offer insights into the growth prospects of such companies. The SME IPOs offer an opportunity for early investment in companies, which may have high growth potential. From the initial expansion and growth of the company following the IPO, the investors could make significant gains on their investments. These stocks also present an opportunity for diversification in an investor’s portfolio. However, they come with risks like high volatility and lower liquidity compared to larger, more established companies. Investors should carefully monitor the latest SME listings to assess the risk-reward scenario.

Frequently asked questions

At what time does an SME IPO get listed on the exchange?

How do I check if a particular SME IPO has been listed?

To check if a specific SME IPO has been listed, you can visit the stock exchange websites like BSE SME or NSE Emerge. These platforms provide updates on recently listed SME IPOs and their performance. You can also check the same on our website at https://upstx.gustya.com/ipo/sme/recently-listed-sme-ipo/. The Upstox app also allows you to track SME IPO performance in real-time, including the latest SME listings. By using the app, you can quickly verify if a stock has been officially listed and monitor any significant price changes post-listing.

How can I evaluate the market response to a recently listed SME IPO?

Where can I find detailed reports on recently listed SME IPOs?

How to apply for IPOs on Upstox

Step 1

Go to www.upstox.com/ipo or open the Upstox mobile app and select the IPO you wish to apply for from the 'Open IPO' section

Step 2

Click on apply, enter the lot size, price and provide your UPI mandate.

Step 3

Approve the UPI mandate on your UPI app and you are all set!