- Home/

- IPO

17.52x

subscribed

Kasturi Metal Composite IPO

Steel & Iron Products

listed

17.52x

subscribed

₹2.44LMin. investment

Kasturi Metal Composite Limited IPO Details

Issue size

₹18Cr

IPO type

SME

Market Cap

₹66.53CrLower than sector avg

Price range

₹61.00 – ₹64.00

Listing ExchangeBSE

RevenueApr 2024 - Mar 2025

₹56.97CrLower than sector avg

Lot size

2000 shares

Draft Red Herring Prospectus

Read

Growth rate3Y CAGR

23.89%

SectorSteel & Iron Products

Price range₹61.00 – ₹64.00

IPO type

SME

Lot size2000 shares

Issue size₹18Cr

Draft Red Herring Prospectus

Read

Market Cap

₹66.53CrLower than sector avg

RevenueApr 2024 - Mar 2025

₹56.97CrLower than sector avg

Growth rate3Y CAGR

23.89%

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

Risk analysis

Debt to Equity ratio

Promoter holdings

Shares pledged

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Capital expenditure

73.83%

General corporate purpose

26.17%

About Kasturi Metal Composite Limited

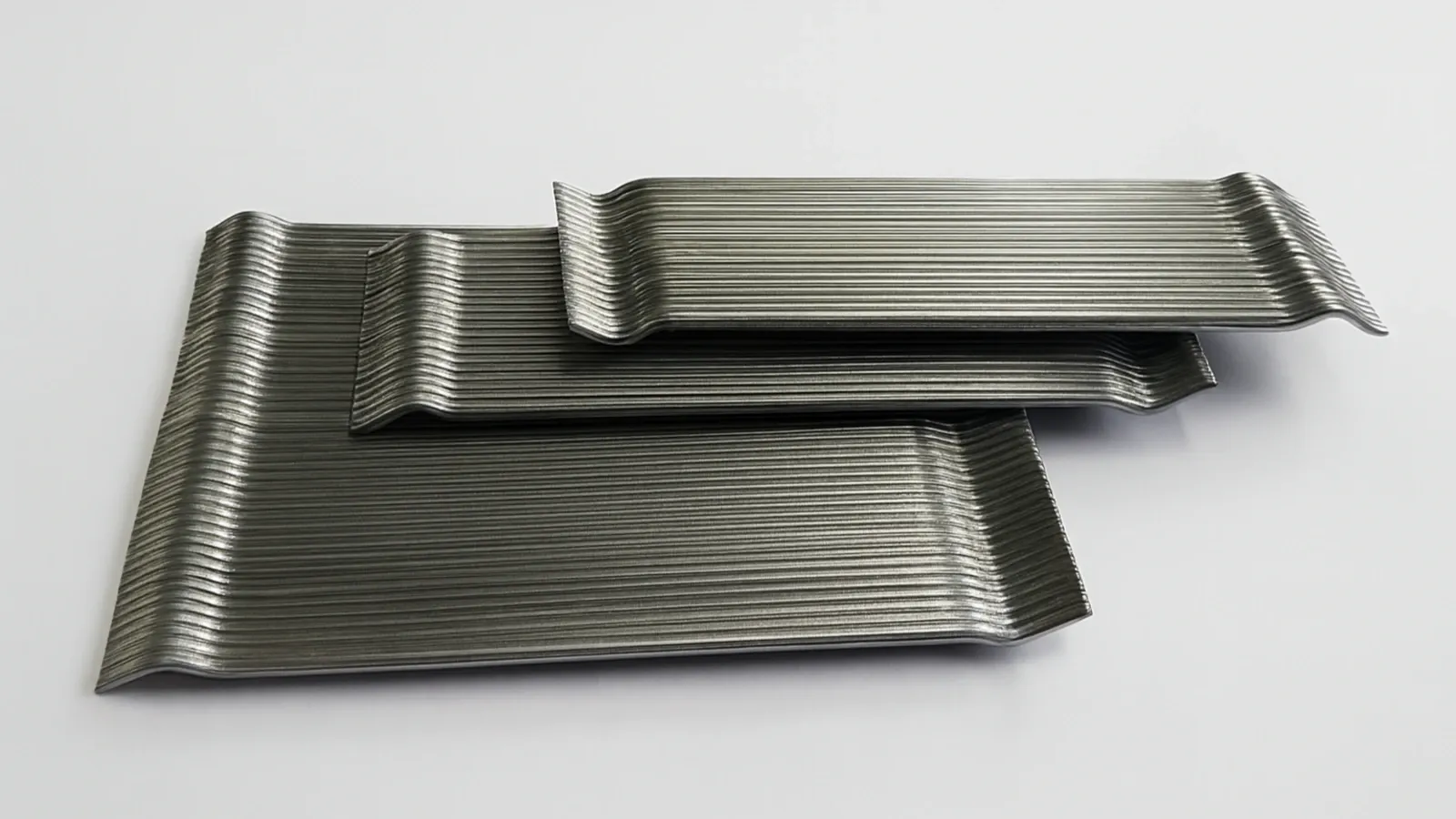

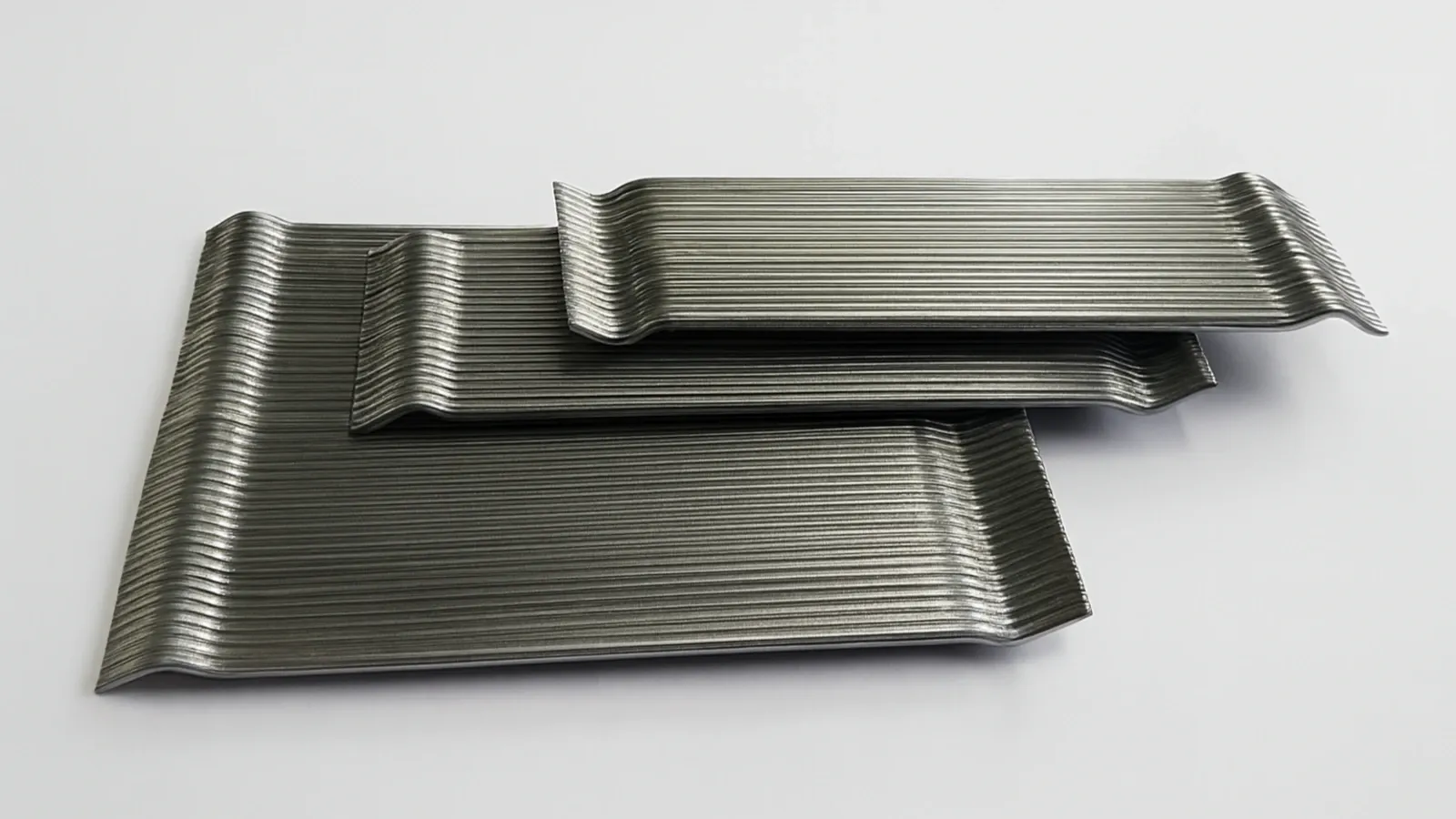

Incorporated in 2005, Kasturi Metal Composite is engaged in manufacturer and export of steel fiber products for industrial and infrastructure uses. The company has three factories in the MIDC industrial area of Amravati, Maharashtra, with a total area of around 6,875 sq. m. Its products are marketed under the brand names Duraflex and Durabond, which find applications in industries such as construction, infrastructure, engineering, warehousing, logistics, mining, and automotive.

The company's range of products comprises loose hook, end steel fiber, glued hook, end steel fiber, and flat crimped steel fiber for reinforced concrete, besides steel wool fiber for automotive brake pads and clutch friction linings. Moreover, the company deals in Macro Synthetic Polypropylene Fibers under the Durocrete brand. Kasturi further extends its business through its subsidiary, Durafloor Concrete Solution LLP (98% owned), which offers tailored concrete flooring solutions.

For H1FY26, the revenue contribution was Duraflex Steel Fiber at 37.62%, flooring work at 33.09%, and Durabond Steel Wool Fiber at 15.98%. The company's operations are mainly domestic as domestic sales make up 98.12% of revenue, while exports, which were just 1.88%, accounted for 6 countries, including Nepal, Bhutan, New Zealand, and Dubai. It currently caters to customers in 10+ states of India, among which Tamil Nadu, Maharashtra, and Madhya Pradesh are its major markets. It runs 28 machines at its plants, while capacity utilisation was 79.20% for loose & glued steel fiber and 65.87% for steel wool fiber during H1FY26. After the expansion, the company intends to incorporate additional capacities of 6,000 MT per annum of loose & glued Steel fiber and 500 MT per annum of Polypropylene fiber.

Kasturi Metal Composite IPO Subscription Status

Latest News on Kasturi Metal Composite IPO

Kasturi Metal Composite IPO: The ₹17.61 crore initial share sale is solely a fresh issuance of 27.52 lakh shares, with no offer for sale component.

3 min read

Kasturi Metal Composite IPO allotment: The ₹17.61 crore initial share sale, with a price band of ₹61 to ₹64 per equity share, was only a fresh issuance of 27.52 lakh shares, without an offer for sale component.

3 min read

Frequently asked questions

How to invest in the Kasturi Metal Composite IPO ?

Investors can apply for the Kasturi Metal Composite IPO through their Demat account via the stock exchange or through their broker.

What is the issue size of Kasturi Metal Composite IPO ?

The issue size of the Kasturi Metal Composite IPO is 18 Cr.

What is 'pre-apply' for Kasturi Metal Composite IPO ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will Kasturi Metal Composite IPO shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.