- Home/

- IPO

1.16x

subscribed

Digilogic Systems IPO

Defence

listed

1.16x

subscribed

₹2.35LMin. investment

Digilogic Systems Limited IPO Details

Issue size

₹81Cr

IPO type

SME

Market Cap

₹301.1CrLower than sector avg

Price range

₹98.00 – ₹104

Listing ExchangeBSE

RevenueApr 2024 - Mar 2025

₹72.06CrLower than sector avg

Lot size

1200 shares

Draft Red Herring Prospectus

Read

Growth rate3Y CAGR

13.48%

SectorDefence

Price range₹98.00 – ₹104

IPO type

SME

Lot size1200 shares

Issue size₹81Cr

Draft Red Herring Prospectus

Read

Market Cap

₹301.1CrLower than sector avg

RevenueApr 2024 - Mar 2025

₹72.06CrLower than sector avg

Growth rate3Y CAGR

13.48%

Checklist

Quality analysis

Revenue growth

Company valuation

Earnings expansion

Risk analysis

Debt to Equity ratio

Promoter holdings

Shares pledged

The investment checklist helps you understand a company's financial

health at a glance and identify quality investment opportunities easily

Compare

Companies in this sectorObjectives

Capital Expenditure

73.91%

General corporate purposes

14.66%

Repayment of borrowings

11.43%

About Digilogic Systems Limited

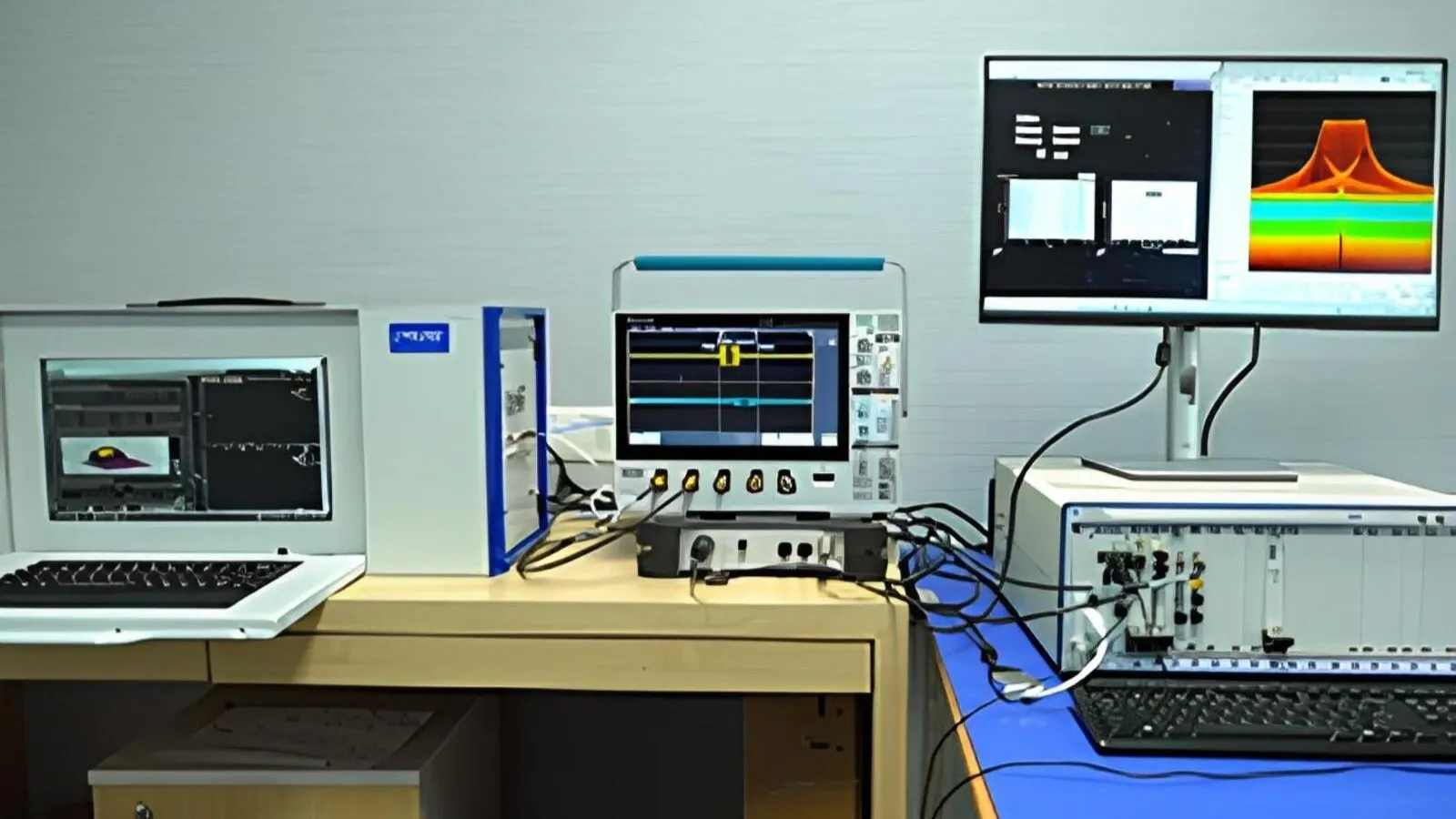

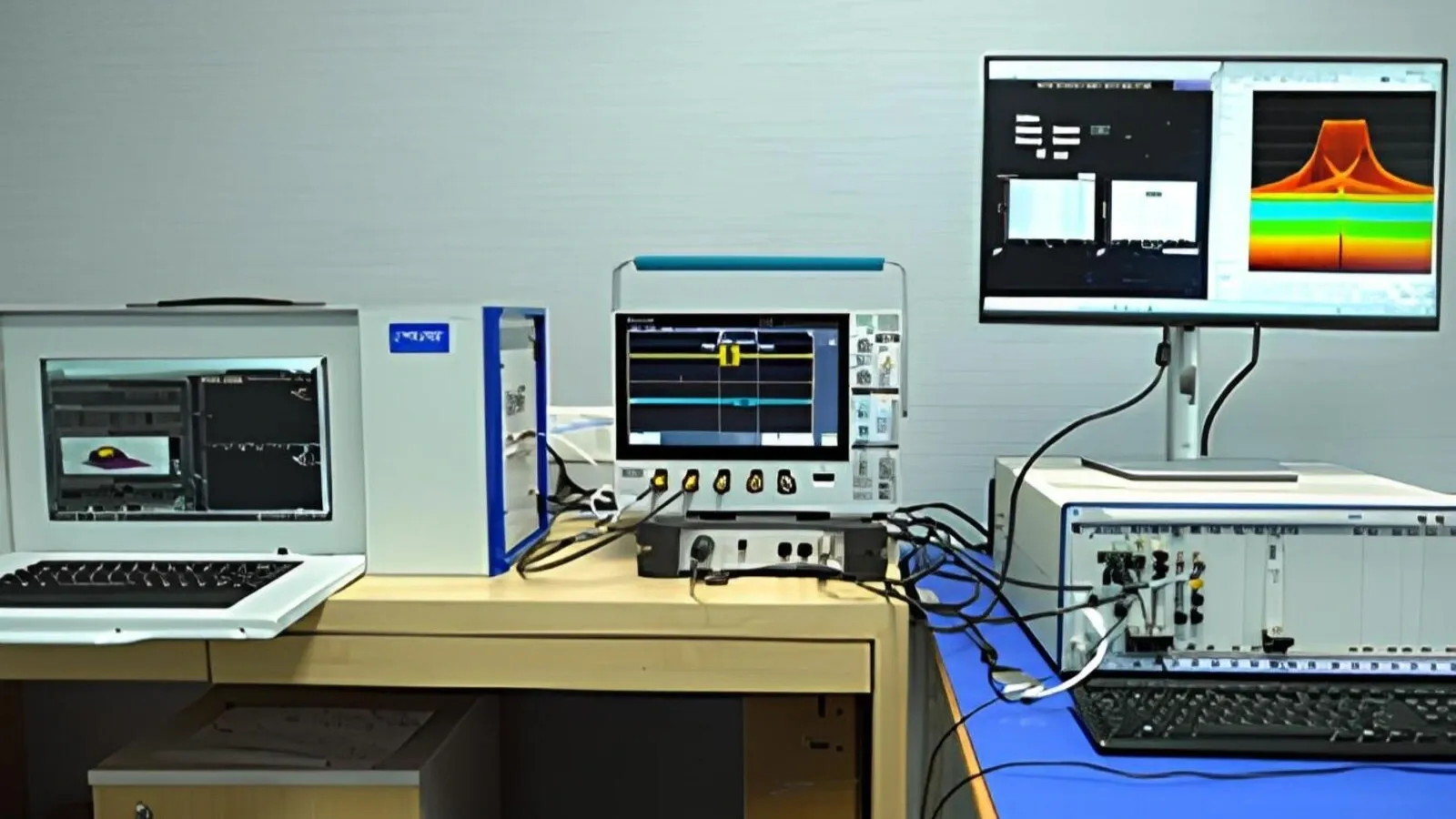

Digilogic Systems designs, develops, manufactures, integrates, and supports test systems, software, and embedded signal processing solutions for the defence and aerospace sector. It supplies automated test equipment, radar and electronic warfare simulators, application software, and related services, with orders largely coming from government entities and their vendors. It operates across three segments: test systems, application software, and services. The company operates a manufacturing facility in Hyderabad. As of September 2025, 91.05% of revenue came from test systems, 2.21% from application software, and 6.74% from services. Industry-wise, 99.02% of revenue came from defence and aerospace, while 0.98% came from industry. Sector-wise, the government accounted for 99.02% of revenue while the non-government segment contributed 0.98%. The company has over 18 years of experience offering systems and solutions to clients in the defence and aerospace sectors, with 98% of revenue coming from repeat customers as of September, 2025.

Digilogic Systems IPO Subscription Status

Latest News on Digilogic Systems IPO

Digilogic Systems IPO: The ₹81.01 crore initial share sale consists of a fresh issuance of ₹69.68 crore and an offer for sale of ₹11.33 crore by promoter Madhusudhan Varma Jetty.

3 min read

Digilogic Systems IPO: The company seeks to raise up to ₹69.68 crore from the fresh issuance of shares and up to ₹11.33 crore from the offer for sale, taking the total issue size to ₹81.01 crore.

2 min read

Digilogic Systems IPO allotment: The ₹81.01 crore issue, with a price band of ₹98 to ₹104 per equity share, was a mix of fresh issuance of shares aggregating to ₹69.68 and an offer for sale (OFS) of ₹11.33 crore by promoter Madhusudhan Varma Jetty.

3 min read

Frequently asked questions

How to invest in the Digilogic Systems IPO ?

Investors can apply for the Digilogic Systems IPO through their Demat account via the stock exchange or through their broker.

What is the issue size of Digilogic Systems IPO ?

The issue size of the Digilogic Systems IPO is 81 Cr.

What is 'pre-apply' for Digilogic Systems IPO ?

Pre-applying for an IPO allows you to submit your application before the official subscription period begins.

Which exchanges will Digilogic Systems IPO shares list on?

The IPO shares will typically list on major stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), as specified in the IPO prospectus.