Insurance that's right for you

We don't sell all types of insurance, we only sell what's right for you

Research backed and data-driven

approach to calculate the ideal cover amount for you

Top insurers

with the highest settlement ratio and lowest complaint volumes

No mis-selling

, we offer only what you truly need

Cutting the kit kit

, we never spam you to buy insurance

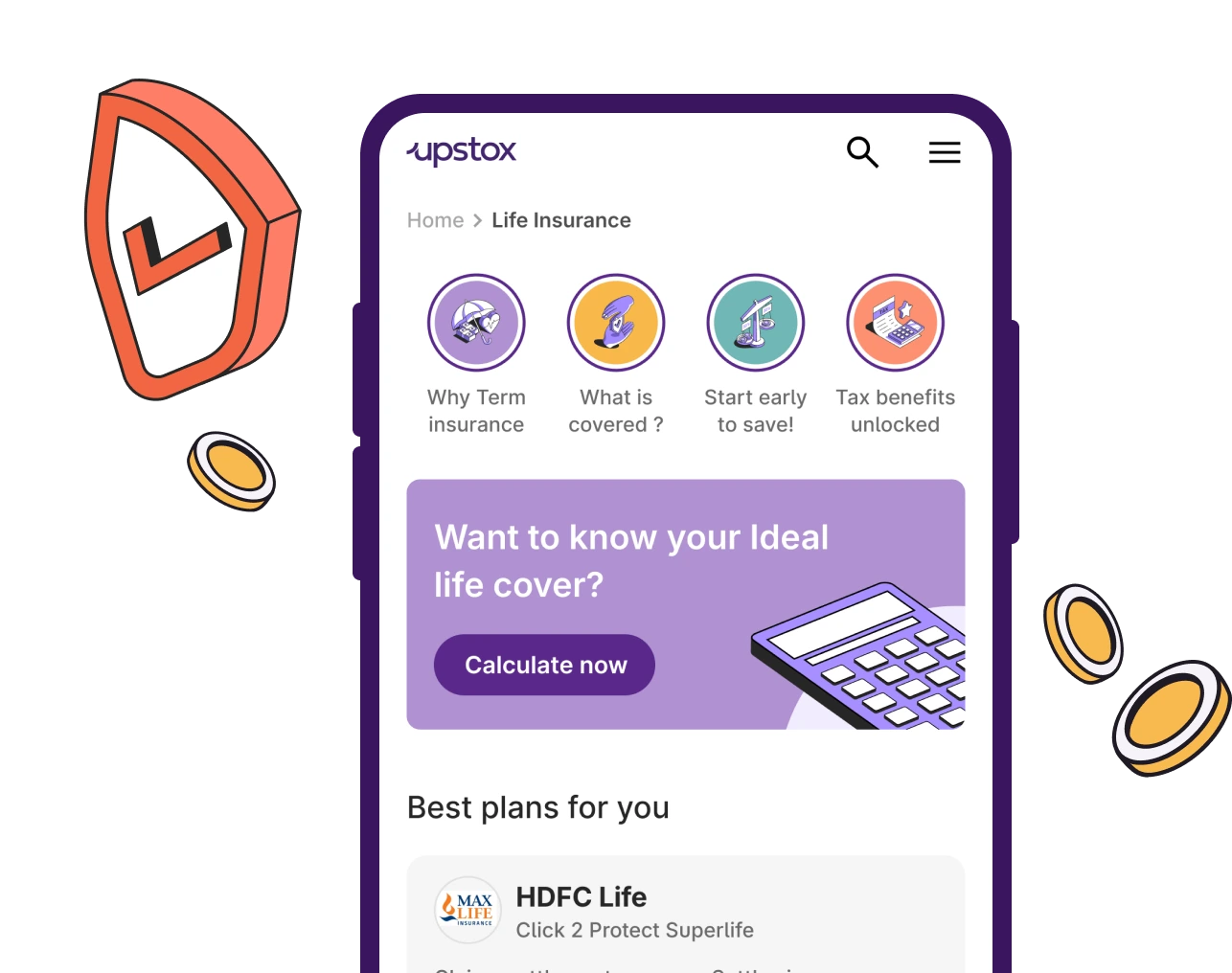

Our offerings

Single platform for all your insurance needs

Term Life

Insurance

Ideal, cost-effective and simplest type of Life Insurance. We stay away from ULIPs or Endowment Plans that are disguised as insurance.

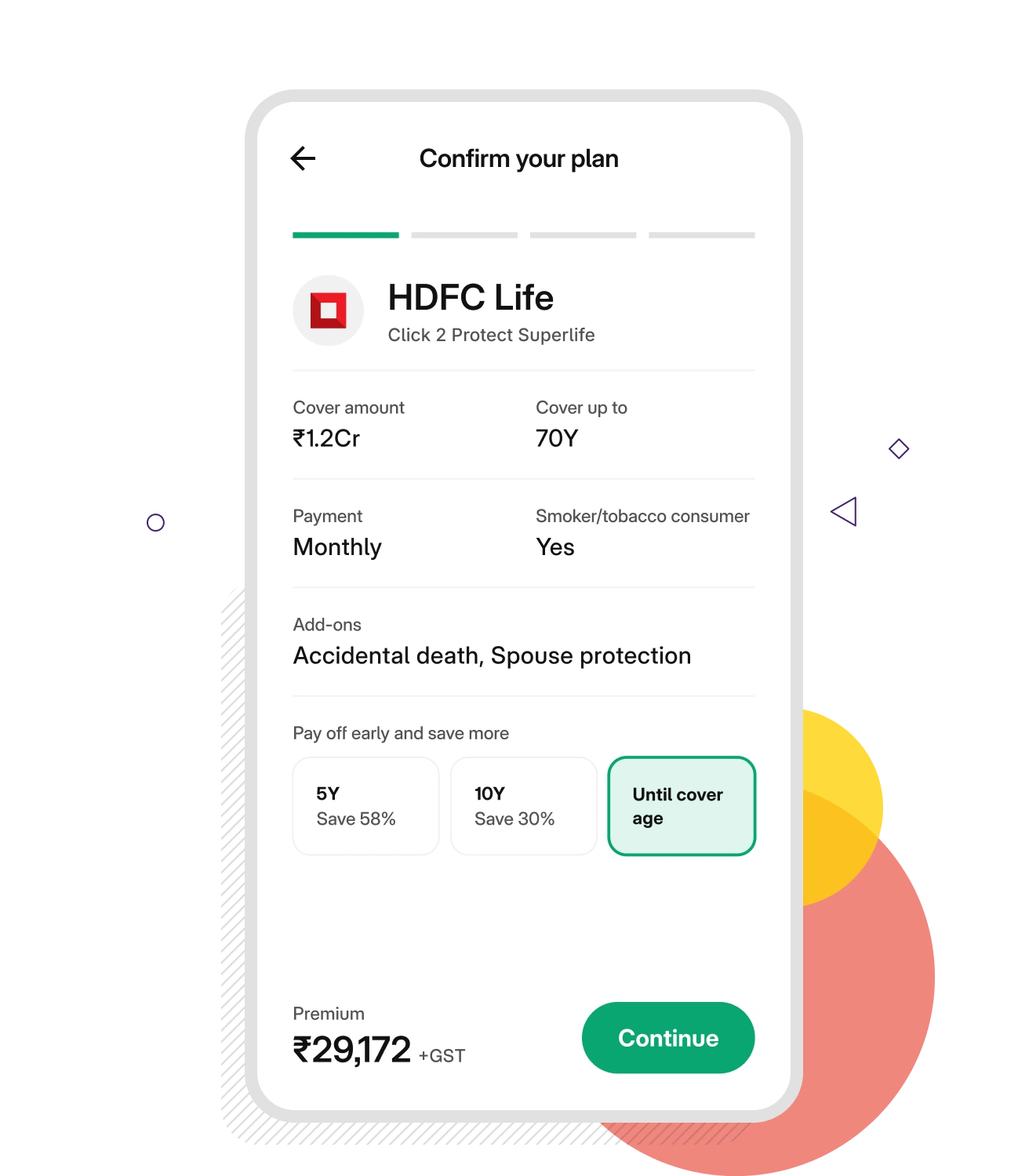

Calculate ideal cover based on your lifestyle, needs and dependents

Only the top plans based on settlement ratio and complaint volumes

Avail tax deductions upto ₹1.5L under section 80C

Powerful add-ons to supercharge your policy:

Accidental Death

Terminal Illness

Spousal Protection

Motor

Insurance

Don't gamble with your wheels. Insure your ride! It's the law, and it's smart.

Calculate ideal cover based on your car’s needs and get your policy issued immediately

Only the top plans based on settlement ratio, complaint volumes, number of cashless garages

Zero-Paper claims within 48 hours

Repair Warranty upto 6 months

Free pick-up and drop from your home to a garage of your choice

Powerful add-ons to supercharge your policy:

Personal Accidental Cover

Bumper to Bumper

Engine Protection Cover

Health

Insurance

Your health is your wealth, and we're here to help you protect it. Stay tuned as we craft the best health plans just for you!

Features & Benefits

Why choose Upstox?

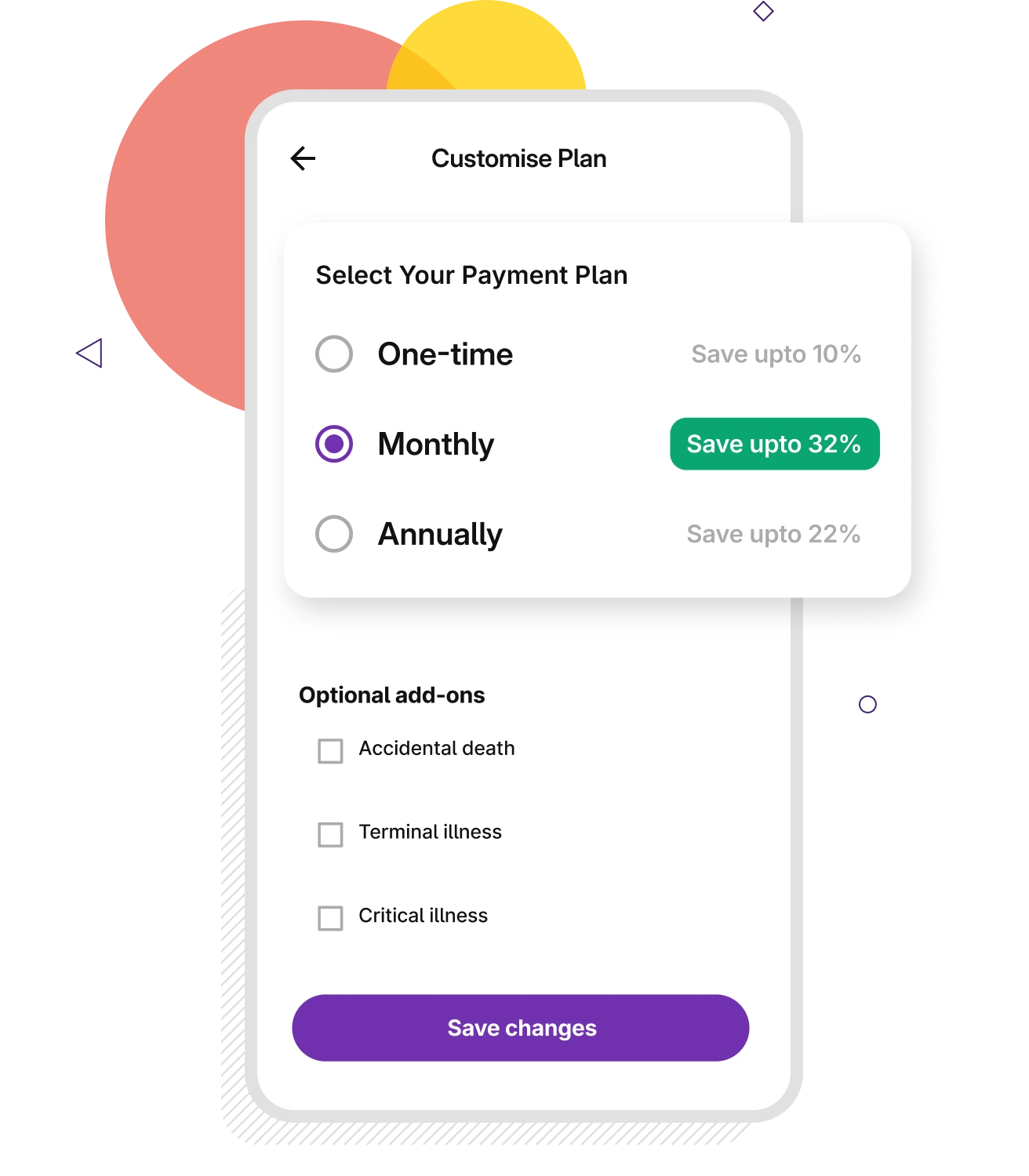

Flexible payments

Choose between monthly, annual or one-time payment schedules

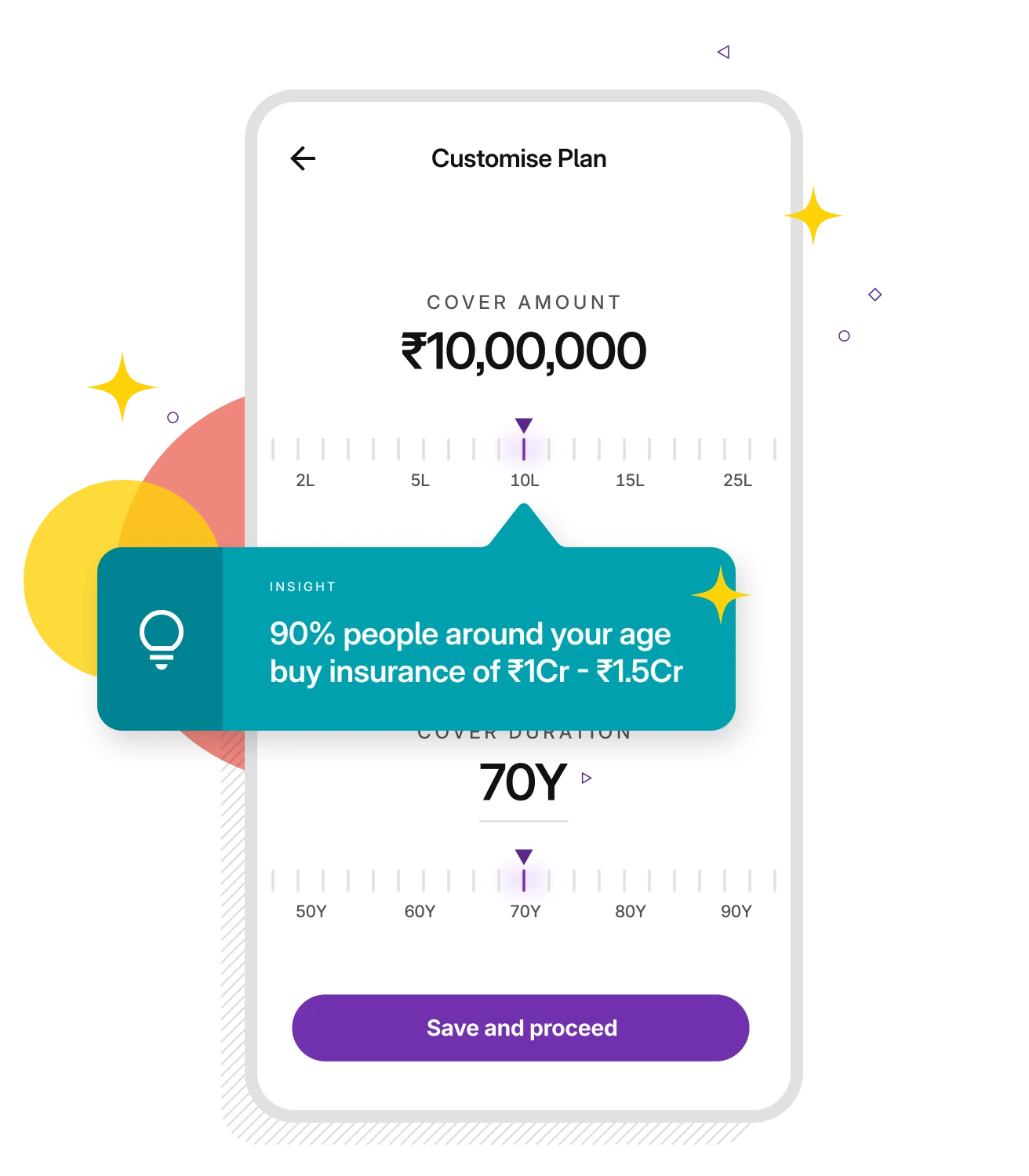

Intelligent insights

Get actionable insights on ideal cover amount, relevant add-ons and how to adjust cover age

Simplified journey

Buy, manage and claim insurance smoothly on our app in just a few clicks

As featured on

Don't wait till tomorrow to get insured.

By signing up, you agree to receive transaction updates from Upstox or the insurance service provider. We will only call you if require any further assistance.

Understanding Insurance: Types and Benefits

Insurance is a financial safeguard where you pay premiums over time in exchange for coverage against monetary losses due to specific events. An insurance policy is a legal contract between an individual (the insured) and an insurance company (the insurer). The insurer agrees to pay a predetermined sum to the policyholder in certain situations to cover losses, in return for premium payments for a specified period.

FAQs

What is the process of buying insurance?

A. Buying insurance can be a taxing process, especially if you're not clear about its goals. However, it can become manageable if you follow these steps:

- First, figure out what amount of coverage you need

- Look at different policies and compare their benefits and costs

- Try to get quotes from several insurers and read the details carefully

- You can also try to get the details from an insurance advisor for help if needed

- Next, choose a policy, fill out the application, and do any required medical tests

- Once approved, make the first payment to start your coverage

P.S. Keep your policy documents safe and review your coverage regularly to make sure it still meets your needs

Why should you buy an insurance plan?

Buying an insurance plan is important because it provides financial protection and peace of mind. Whether you're buying health, life, or property insurance, you get covered for unexpected events like illness, accidents, or loss. An insurance can help you cover expenses that could otherwise bring a huge financial loss to you and your family. Hence, getting an insurance would be like a safety net to protect your wealth from future uncertainties.

How to save income tax through insurance?

One of the many benefits of having insurance is that you can save tax with it. Here are some of the tax benefits offered by the government:

Which insurance gives tax benefits?

Both Life and Health Insurance policies offer tax benefits. Here are the benefits:

Can we take out a loan on insurance?

Yes, you can take out a loan against life insurance policies. However, it may also depend on your insurer's terms and conditions. For such a loan, your insurance will act as the collateral against the loan amount. Such loans are becoming popular because of their lower rates compared to personal loans.

What is term life insurance?

Term life insurance, as the name suggests, is a type of insurance that covers you for a specific term--like 10, 20, or 30 years. If the insured person passes away during the term, the family gets money. Term insurance is popular because of its affordability compared to other types of insurance.

What are the benefits of term life insurance?

Here are some of the benefits of Term life insurance:

- Term life insurance is usually more affordable than other types of life insurance

- Term life insurance policies are straightforward and easy to understand

- This insurance financially secures your loved ones by providing a payout in case of the death of the insured person

What is motor insurance?

Motor insurance is a policy that provides financial protection against vehicle damages. It can cover all types of vehicles, including individual cars, motorcycles, and commercial vehicles. Motor insurance policies provide financial protection against unexpected events such as accidents, theft or damages caused to third parties. Comprehensive Motor Insurance policies not only covers third-party damages but also own vehicle's damages.

The benefits of motor insurance include:

- Covers repair costs for your vehicle in case of accidents, theft, or natural disasters

- Provides coverage for damages and even injuries caused to other people or other people's property

- Covers medical bills for injuries sustained by the driver or passengers

- Helps you face legal requirements with less stress during accidental cases

- Offers cashless repair services in network garages

What is health insurance?

Health insurance is a type of insurance coverage that pays for medical expenses. It can cover expenses incurred from illness or injury of the insured person. A typical health insurance covers doctor visits, hospital stays, prescription medications, preventive care, surgeries, ambulance charges, and more. It ensures you receive necessary medical care without worrying about the burden of unexpected bills.

What are the benefits of health insurance?

Here are some of the key benefits of health insurance:

- Protection from rising medical bills: Medical inflation in India will increase to 11% in 2024. During such a time, having health insurance can be invaluable to safeguard you from the rising medical costs

- Hassle-free cashless treatment: Most health insurance policies provide cashless services in network hospitals. This reduces the hassles of payment at the hospital

- Pre-and post-hospitalisation support: Many treatments require pre and post hospitalisation that can cause financial burden on you. But the right health insurance policy can cover all these essential medical needs

- Regular wellness check-ups: Not just for a treatment, your health insurance can help you stay ahead of health issues with yearly wellness check-ups

- Tax savings: The premiums you pay for Health Insurance policies are eligible for deductions under Section 80D. You can claim up to ₹25,000 per year for yourself, your spouse, and your children

- No-claim bonus: Many Health Insurance policies offer bonus benefits for not making claims during the policy period. This allows you to increase your coverage without paying extra

Why choose Upstox to buy an insurance plan?

Picking the right insurance plan can be challenging. That's why Upstox comes with the mission of simplifying insurance plans for you and your family.

Here are some of the reasons why to choose Upstox to buy an insurance plan: